Blog

•

Jan 30, 2026

The Definitive VC Tech Stack: 500+ Tools Funds are Actually Using in 2026

👉 We've covered 65+ of the most popular tools below. Our full database covers 500+ platforms, organized by workflows. Download the complete list here.

In 2021, Gartner made a tall prediction: 75% of VC investment decisions would be informed by AI and data analytics by 2025. Well into 2026, are VCs finally eating their own cooking?

Over the past few years, AI has dramatically accelerated VC-tech, helping investors improve both outcomes (i.e., find interesting companies, close deals faster, etc.) as well as inputs (i.e., human time spent on fund activities).

SignalFire's Beacon AI, for example, refined for over a decade, can map 650 million individuals and 80 million organizations precisely. Coatue launched "Coatue Brain" in 2023, integrating genAI into Mosaic, their $80 million, 12-year data fortress ingesting SEC filings and beyond. Today, the momentum extends to custom GPTs like MiniVC (David Teten's AI avatar embedding 20+ years of private markets experience) and co-pilots like Kruncher designed for screening deals, drafting memos, monitoring portfolios, and handling LP operations.

Leading firms are already using AI at every stage of the investing process:

Sourcing: Scraping millions of signals to surface non-obvious opportunities early

Screening & diligence: LLMs cluster deals, draft memos, assess risks at 500x human speed

Relationship intelligence: Mapping founder, operator, and investor networks to surface warm paths, track engagement, and preserve firm-wide relationship context

Portfolio tracking: Replacing quarterly updates with continuous, real-time visibility

Reporting: Generating LP-ready reports on demand

Tools now handle everything, from relationship mapping to term sheet generation, freeing partners for founder relationships and high-touch decisions.

What you'll find in this guide:

500+ tools across 12 categories organized by actual VC workflow (deal sourcing → portfolio monitoring → fund ops)

Comparison tables for quick evaluation

Stage-specific recommendations

Frequently asked questions about the VC tech stack.

At a Glance: The Complete 2026 VC Tech Stack

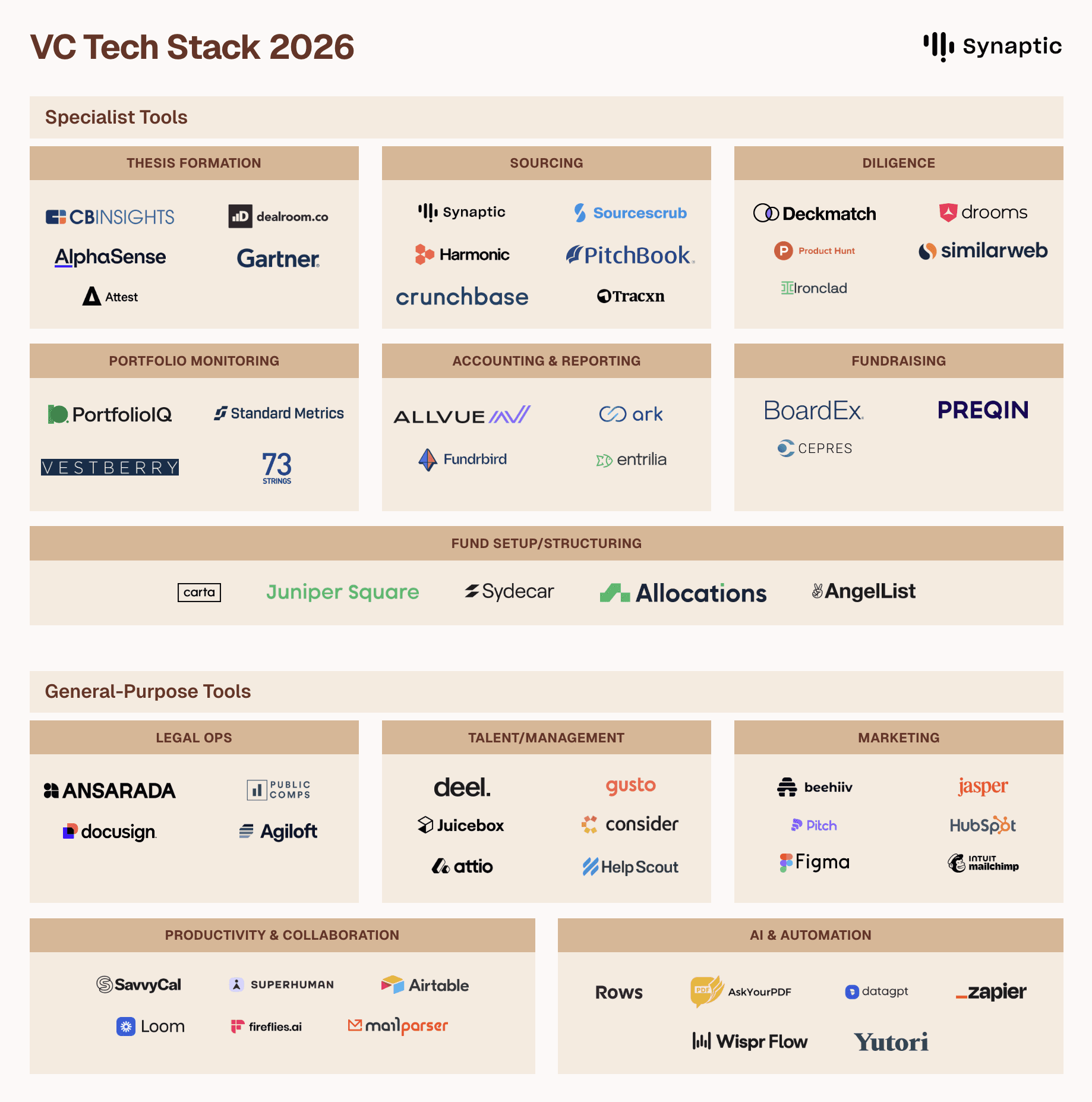

We’re categorizing the tools into two broad groups based on their key functionality:

Specialist Tools: Purpose-built for core VC workflows like sourcing, diligence, portfolio monitoring, reporting, and more.

General-purpose Tools: Horizontal tools not built for VCs, but widely used across funds for research, collaboration, automation, and everyday work. They provide flexibility and speed, but require customization to fit VC workflows.

👉 Our full database covers 500+ tools for VCs, mapped across the investment lifecycle. Download the complete list here.

Specialist Tools

Functional categories | What it solves | Most popular tools |

|---|---|---|

Thesis Formation | Crafting the investment strategy based on market analysis and trends. | CB Insights, Dealroom, AlphaSense |

Sourcing | Identifying and evaluating potential investment opportunities. | Synaptic, Sourcescrub, Harmonic, PitchBook |

Diligence | Thoroughly analyzing potential investments for risks and opportunities. | Deckmatch, Drooms, Product Hunt |

Portfolio Monitoring | Overseeing the performance and management of portfolio companies. | PortfolioIQ, Standard Metrics, Vestberry |

Accounting and Reporting | Managing financials and reporting to investors. | Allvue Systems, ArkPES, Fundrbird |

Fund Setup/Structuring | Establishing the legal and operational framework of the fund | Carta, Juniper Square, Sydecar |

Fundraising | Securing capital commitments from limited partners and investors. | BoardEx, CEPRES, Preqin |

General-purpose Tools

Functional categories | What it solves | Most popular tools |

|---|---|---|

Legal Ops | Finalizing the investment through negotiations and legal execution. | Ansarada, Docusign |

Talent/Management | Assembling a skilled team for investing, fund management and operations. | Deel, Getro, Juicebox |

Marketing | Promoting the fund to potential investors and stakeholders. | Beehiiv, Jasper, Pitch |

Productivity & Collaboration | Supporting everyday VC operations like communication, coordination, documentation, and knowledge sharing. | SavvyCal, Superhuman, Airtable, Loom |

AI & Automation | Reducing manual work across VC workflows by automating research, analysis, and routine execution. | Rows, AskYourPDF, DataGPT |

Specialist Tools for VCs

Thesis Formation: Tools for market and sector insights

Also known as: Market Research, Investment Strategy, Sector Analysis

Tools helping VCs understand markets, identify long-term trends, map sectors, define investment strategy and form conviction.

Tool | key Features | Best for |

|---|---|---|

CB Insights | AI-driven market intelligence, Predictive analytics for emerging trends, Startup discovery via Mosaic scoring, Funding alerts, Investor benchmarking, and CRM integrations | Growth-stage VCs and mid-to-large funds ($100M+ AUM |

Dealroom | Real-time funding data, Market maps, Sector benchmarking, Growth signals (hiring/revenue), Collaborative team tools [conversation_history] | International or Europe/India/SEA-focused VCs, corporate venture teams, and mid-sized funds ($50M+ AUM) |

AlphaSense | AI-driven Generative Search across 500M+ documents (broker research, transcripts, filings), Deep Research agents for IC memos/landscapes, Smart Synonyms, financial KPIs,Real-time alerts, CRM/Snowflake integrations | Mid-to-large VCs and growth-stage funds ($100M+ AUM) focused on tech/AI sectors |

S&P Global | Comprehensive private market data including Cap IQ for M&A/debt details, Company financials, ownership tracking, Sector reports | Growth-stage and late-stage VCs ($100M+ AUM) or funds with public-market exposure |

Gartner | Strategic research reports, Vendor rankings (Magic Quadrants), Tech trend forecasts | Mid-to-large funds ($200M+ AUM) and growth-stage VCs |

Attest | On-demand consumer surveys (110M+ panel), Audience targeting (demographics/behaviors), Real-time dashboards/AI insights, Brand tracking | Early- and growth-stage VCs ($50M–$500M AUM) focused on consumer-facing companies, marketplaces, or B2C tech |

CB Insights

CB Insights provides AI-powered predictive intelligence on private companies, markets, and competitive signals. Its flagship Mosaic score uses AI-driven algorithms to evaluate company health, growth momentum, financial strength, management quality, and exit potential.

Primary use case: VCs leverage its vast dataset (covering 10M+ global firms) to spot emerging trends, forecast winners ahead of the market, and visualize sector maps for sharper thesis formation.

Best for: Mid-to-large VCs and corporate venture arms ($100M+ AUM) focused on tech/AI sectors, thesis-driven scouting, and predictive forecasting in competitive landscapes.

Dealroom

Dealroom is a global startup intelligence platform with deep coverage of emerging ecosystems (especially Europe, India, SEA), tracking millions of companies, funding rounds, and sector trends.

VCs can discover early-stage founders, map regional/global trends, build mandate-aligned pipelines, and source deals systematically across borders.

Primary use case: Map emerging ecosystems, track sector maturity (e.g., European AI vs. US benchmarks), and identify geographic investment opportunities with visual landscapes and trend analysis.

Best for: International or Europe/India/SEA-focused VCs, corporate venture teams, and mid-sized funds ($50M+ AUM) prioritizing global/regional coverage, visual maps, and collaborative insights for thesis and pipeline building.

AlphaSense

AlphaSense is an AI-powered market intelligence platform aggregating 150M+ premium documents like broker research, filings, transcripts, and financial data. Its GenAI workflows and agents synthesize insights with sentence-level citations, automating research from company profiles to competitive benchmarking without hallucinations.

Primary use case: Unifying fragmented sources for rapid sector analysis, earnings prep, diligence, and trend spotting, enabling confident thesis formation amid complex markets.

Best for: Mid-to-large VCs and growth-stage funds ($100M+ AUM) focused on tech/AI sectors

S&P Global

S&P Global is a leading provider of financial intelligence, market data, and analytics through platforms like S&P Capital IQ, offering comprehensive coverage of public/private companies, industry reports, credit ratings, economic data, and ESG insights.

Primary use case: VCs harness its data for benchmarking portfolios against indices like Cambridge Associates, tracking funding trends (e.g., H1 2025 VC up 25% globally), and private equity outlooks to build robust sector theses and diligence targets.

Best for: Growth-stage and late-stage VCs ($100M+ AUM) or funds with public-market exposure needing institutional-grade financial data, industry research, and macro intelligence to support thesis development and diligence.

Gartner

Gartner is a leading research and advisory firm delivering market intelligence, benchmarks, and expert guidance to enterprise and investment teams.

Its flagship frameworks like Magic Quadrant and Hype Cycle synthesize expert analysis and vetted data to map sectors, assess category maturity, and form investment conviction around emerging and established markets.

Primary use case: Ground sector and technology diligence in trusted research and objective competitive mapping to validate market assumptions and identify landscape leaders and challengers.

Best for: Mid-to-large VCs and corporate venture arms ($100M+ AUM) focused on enterprise, B2B, or tech-enabled sectors

Attest

Attest is a consumer research platform that enables fast, global surveys across millions of respondents in 59+ countries. It helps teams validate demand, test concepts, and track consumer trends through built-in survey design, quality controls, and analysis dashboards.

Primary use case: Conduct consumer surveys to validate market demand, test concepts, and gather quantitative insights that inform investment theses in the consumer, fintech, and digital sectors.

Best for: Early- and growth-stage VCs ($50M–$500M AUM) focused on consumer-facing companies, marketplaces, or B2C tech where direct consumer validation is critical.

Sourcing: Tools for founder and startup discovery

Also known as: Deal Flow Management, Pipeline Management

Tools helping VCs discover investment opportunities, manage inbound deal flow, track warm introductions, and build sourcing pipelines.

Tool | key Features | Best for |

|---|---|---|

Synaptic | AI natural-language search by thesis, Founder/people search + talent signals, Real-time alerts & growth monitoring, Automated relationship mapping to surface warm paths | Growth-stage and mid-to-large VCs ($100M+ AUM) focused on data-driven sourcing |

Crunchbase | Real-time startup/funding/trend tracking, AI Scout for searches & predictions, Market reports & growth signals | Early- to growth-stage VCs and smaller-to-mid-sized funds |

Harmonic | AI-powered signal aggregation (web traffic, hiring, launches), Scout AI for instant market maps & talent flows, Predictive scoring & warm intro alerts | Seed-to-Series B VCs ($50M+ AUM) focused on early-stage pattern recognition |

SourceScrub | Private company financials (revenue, EBITDA), Ownership structures & contact data, AI filtering, enrichment & list building, Buy-side intelligence & portfolio benchmarking | Mid-to-large VCs and PE firms ($100M+ AUM) focused on scaling pipelines, especially in Europe/UK |

Grata | AI web scraping & natural language search, Real-time indexing of websites/job posts/press, Agentic AI search & thematic maps, Live teasers & dealmaker network | Mid-to-large VCs and growth equity funds ($100M+ AUM) seeking deals in non-obvious sectors |

Tracxn | 2100+ sector taxonomies with quarterly reports, Proprietary scores, Maps & quarterly reports, Strong emerging-market coverage (India, SEA, Africa, Europe) | Mid-sized to large VCs ($50M+ AUM) and international funds |

PitchBook | Comprehensive private market data coverage (e.g., ~6M companies, 2.7M+ investments, 570K+ investors, 147K+ funds), Advanced search & screening, Built-in comparisons & analytics tools, Real-time & predictive signals | Institutional and mid-to-large VCs ($100M+ AUM) |

Synaptic

Synaptic is a purpose-built AI-powered data intelligence platform trusted by firms like Felicis, Index Ventures, Tiger Global, and Kleiner Perkins. It unifies alternative datasets (hiring velocity, web traction, product reviews, funding, firmographics, and more) with proprietary sources to spot startups early, research deeply, and track growth signals.

Its natural-language AI search matches intent without filters, enabling thesis-aligned discovery, founder/people search by experience/connections, team insights (hires, exits, talent flows), real-time alerts, and automated monitoring for portfolio or sector tracking.

Primary use case: AI-driven startup discovery, outbound sourcing, and signal monitoring to build high-conviction deal pipelines from alternative data and real-time intelligence.

Best for: Growth-stage and mid-to-large VCs ($100M+ AUM) focused on data-driven sourcing and scaling pipelines in competitive private markets.

Crunchbase

Crunchbase is a comprehensive startup and investor database tracking 4M+ companies, 1.6M+ funding rounds, and 800K+ investors globally.

Powered by AI features like Crunchbase Scout for natural-language searches, predictive signals, personalized recommendations, and quick summaries, it helps VCs spot emerging companies, track sector momentum, and identify high-potential trends.

Primary use case: Map emerging sectors, track funding velocity, identify breakout companies early, and monitor competitive dynamics to build data-backed investment theses.

Best for: Early- to growth-stage VCs and smaller-to-mid-sized funds seeking affordable, comprehensive startup intelligence and quick insights into emerging trends or founders.

Harmonic

Harmonic is an AI-native startup discovery engine with a database of 30M+ companies and 190M+ people. It aggregates real-time company, funding, talent, and network data to help investors uncover promising startups earlier.

Powered by Scout AI, it delivers instant market maps, talent flows, founder evaluations, competitor analysis, real-time signals (funding, hires, launches), and actionable alerts for warm intros and optimal outreach.

Primary use case: Identify breakout companies early by detecting growth signals across unstructured data sources, enabling VCs to reach founders before competitors and build conviction through momentum tracking.

Best for: Seed-to-Series B VCs ($50M+ AUM) focused on proactive sourcing and early-stage pattern recognition

Sourcescrub

Sourcescrub is an AI-driven deal sourcing platform aggregating data on 17M+ private companies from 290,000+ sources and lists.

It combines proprietary data collection, buy-side intelligence, and relationship mapping to help investors identify acquisition targets, investment opportunities, and market trends across lower and middle-market companies.

Primary use case: Run investment criteria against broad sources, identify under-the-radar opportunities, build direct origination lists, and shift from passive to proactive sourcing, especially for conference and list-based targeting.

Best for: Mid-to-large VCs and PE firms ($100M+ AUM) focused on scaling pipelines in private markets, especially in Europe/UK

Grata

Grata is an AI-powered private markets intelligence platform combining investment-grade data on 19M+ companies, an active dealmaker network, and agentic AI for smarter sourcing and rapid screening.

It aggregates fundamentals, filings, transactions, executive contacts (8M+), conference lists, curated targets, and live deal teasers with verified financials.

Primary use case: AI-driven deal sourcing, target discovery, and early screening by leveraging contextual search, alternative data, and proprietary intelligence in fragmented or emerging markets.

Best for: Mid-to-large VCs and growth equity funds ($100M+ AUM) seeking deals in non-obvious sectors or geographies.

Tracxn

Tracxn is a comprehensive market intelligence and data platform tracking 5M+ private companies globally across 3000+ sectors and 30+ geographies, with daily updates on funding rounds, acquisitions, investors, and emerging themes.

Primary use case: Map sectors, track competitive dynamics, and validate theses across 2,100+ granular verticals from D2C pet care to embedded fintech.

Best for: Mid-sized to large VCs ($50M+ AUM) and international funds focused on broad geographic coverage (e.g., India, SEA, Europe) and emerging sectors.

PitchBook

PitchBook is a premier private market data and research platform delivering comprehensive data on 4.7M+ companies, 1.9M+ deals, valuations, funding histories, investor profiles, and sector benchmarks worldwide.

VCs can surface deals using advanced filters, competitive analysis, due diligence comps, fundraising trends, and LP reporting.

Primary use case: Deal sourcing through deep private market discovery, funding trend analysis, sector mapping, and competitive intelligence

Best for: Institutional and mid-to-large VCs ($100M+ AUM) needing precise, due diligence-grade private market data.

3. Diligence: Tools for investment due diligence

Also known as: Due Diligence, Investment Analysis, Deal Evaluation

Tools supporting structured analysis of markets, financials, teams, technology, and risks before investment.

Tool | key Features | Best for |

|---|---|---|

Deckmatch | AI-powered pitch deck analysis & automated scoring, Benchmarking against thousands of successful decks, Instant feedback on narrative, financials, and market positioning | Early- to growth-stage VCs, emerging managers, and angel groups ($10M–$100M+ AUM) |

SimilarWeb | Web/app traffic analytics for 100M+ sites, Traffic source breakdown & audience demographics, Competitive benchmarking & market share trends, Engagement metrics & conversion funnel analysis | Growth- and late-stage VCs ($100M+ AUM) targeting digital-heavy sectors |

Drooms | Secure VDR with enterprise-grade encryption, Audit trails, AI document indexing & automated redaction, Structured Q&A workflows, Real-time collaboration across deal teams | Mid-to-large VCs and growth-stage funds ($100M+ AUM) |

Product Hunt | Launch performance tracking & trend signals across AI/SaaS/dev tools, Category curations, Early signal alerts, Real-time community sentiment & feedback quality | Early- to growth-stage VCs ($50M+ AUM) |

Ironclad | AI-assisted redlining/suggestions, Conditional workflows, Obligation tracking, Version history, Integrations with CRM (e.g., Salesforce), e-signature tools | Mid-to-large VCs and growth-stage funds ($100M+ AUM) |

Deckmatch

DeckMatch is an AI-powered deal flow automation platform that processes pitch decks (PDFs, Pitch.com, DocSend, Google Docs, websites) from receipt to memo, using advanced models (GPT-4, Claude 3.5) plus OCR, NLP, and enrichment from external sources for structured analysis.

Primary use case: Automated pitch deck analysis and due diligence acceleration through AI parsing, enrichment, memo generation, and thesis matching

Best for: Early- to growth-stage VCs, emerging managers, and angel groups ($10M–$100M+ AUM) handling high-volume inbound deal flow

SimilarWeb

Similarweb is a digital intelligence platform providing web traffic analytics, competitive benchmarking, and market insights across 100M+ websites and apps, with 10+ years of historical data.

It tracks traffic sources, user behavior, audience demographics, search trends, app performance, and competitive benchmarks, enhanced by AI features like trend detection and GenAI intelligence for brand visibility in AI search.

Primary use case: Digital due diligence through web/app metrics, traffic benchmarking, and trend analysis to validate market fit, momentum, and risk before investment.

Best for: Growth- and late-stage VCs ($100M+ AUM) targeting digital-heavy sectors (consumer tech, e-commerce, fintech, SaaS) where online performance metrics drive strong conviction.

Drooms

Drooms is a secure, AI-powered virtual data room (VDR) and due diligence platform designed for transactions, including M&A, fundraising, and asset lifecycle management.

It provides enterprise-grade security with granular permissions, audit trails, watermarking, and AI-powered document indexing. The platform supports structured Q&A workflows, automated redaction, and real-time collaboration across deal teams and advisors.

Primary use case: Secure, efficient due diligence via AI-assisted document organization, access control, and analytics to evaluate markets, financials, teams, tech, and risks before committing capital.

Best for: Mid-to-large VCs and growth-stage funds ($100M+ AUM) handling complex, international, or high-stakes deals

Product Hunt

Product Hunt is a product discovery platform where 10M+ users discover and discuss new tech products, apps, and tools daily. It provides metrics like vote counts, comment sentiment, rankings (e.g., #1 Product of the Day), historical launch data, and topic-based discovery to gauge early traction, user feedback, market validation, and momentum signals.

Primary use case: Evaluate early traction, market validation, and user sentiment through launch metrics, feedback, and rankings before committing to early-stage deals.

Best for: Early- to growth-stage VCs ($50M+ AUM) scouting consumer-facing, B2C, SaaS, or dev-tool startups.

Ironclad

Ironclad is an AI-powered contract lifecycle management (CLM) platform that automates negotiation, review, redlining, approvals, and execution for investment agreements, term sheets, and closing documents. It offers AI-driven contract negotiation, review, and closing automation to finalize investments faster with reduced risk and manual effort.

Primary use case: Streamline complex negotiations, reduce legal back-and-forth, ensure compliance, and accelerate final execution of investment docs (SAFEs, equity rounds, side letters).

Best for: Mid-to-large VCs and growth-stage funds ($100M+ AUM) handling sophisticated or high-volume deals

4. Portfolio Monitoring: Tools for tracking portfolio performance

Also known as: Portfolio Tracking, Performance Monitoring, Portfolio Management

Tools for ongoing tracking of portfolio company performance, KPIs, reporting cadence, and early warning signals.

Tool | key Features | Best for |

|---|---|---|

PortfolioIQ | Automated data collection, Standardized metrics with audit trails, Company intelligence hub (performance, ownership, notes), Automated quarterly reports, Benchmarking/analytics, Qualitative insights from document themes. | Mid-to-large VCs and multi-stage/multi-strategy funds ($100M+ AUM) |

Standard Metrics | Real-time dashboards, Peer benchmarking, Automated LP reporting (quarterly updates, IRR/DPI/TVPI), Performance scoring, Trend analysis, Exportable insights. | Mid-to-large VCs and institutional funds ($100M+ AUM) |

73 Strings | Automated structured data collection (multi-language support), AI-ready models for pattern detection/historical analysis/scenario modeling, Real-time dashboards with drill-down metrics, AI extraction, Audit trails | Mid-to-large VCs, growth equity, and institutional funds ($100M+ AUM, especially global or complex portfolios) |

Vestberry | KPI collection from portfolio companies, Standardized metrics with audit trails, peer benchmarking (industry/vintage), Automated quarterly/fund-level reports (DPI, TVPI, IRR), Valuation modeling | Mid-to-large VCs and growth equity funds ($100M+ AUM) |

Chronograph | Flexible KPI/qualitative tracking with real-time validations and audit trails, Automated quarterly reporting and LP communications, Extensible analytics/benchmarking, ESG data management, Data warehousing/APIs | Mid-to-large VCs, growth equity, and institutional funds |

PortfolioIQ

PortfolioIQ is an AI-powered portfolio monitoring tool that unifies scattered data (KPIs, cap tables, valuation models, documents) into a single source of truth, with proprietary AI extraction and 100% human-verified accuracy.

It automates data requests, extracts/standardizes metrics with audit trails, generates qualitative insights, benchmarks across companies/inbound deals, and auto-populates quarterly company/fund-level reports from templates.

Primary use case: Track ongoing portfolio performance, spot changes early, reduce manual reporting effort (saving 500+ hours/year), and generate fund-level insights for confident decisions and LP updates.

Best for: Mid-to-large VCs and multi-stage/multi-strategy funds ($100M+ AUM) needing accurate, scalable handling of unstructured data and automated reporting in complex portfolios.

Standard Metrics

Standard Metrics is a leading portfolio monitoring and benchmarking platform for VCs and growth investors, standardizing KPIs from portfolio companies via secure data connectors, templates, and automated collection.

Primary use case: Track portfolio health, spot red flags early, compare companies against industry benchmarks, and generate professional LP updates with minimal manual effort.

Best for: Mid-to-large VCs and institutional funds ($100M+ AUM) focused on data-driven portfolio management, LP transparency, and consistent benchmarking in growth-stage investments.

73 Strings

73 Strings is an AI-powered platform for portfolio monitoring and valuations, integrating data extraction from structured/unstructured sources, real-time performance analytics, and automated equity/credit valuations for alternative asset managers.

Primary use case: AI-driven, real-time monitoring of portfolio performance, KPIs, and trends from unstructured/structured data, enabling proactive oversight, predictive analysis, and automated reporting for LP transparency.

Best for: Mid-to-large VCs, growth equity, and institutional funds ($100M+ AUM, especially global or complex portfolios)

Vestberry

Vestberry is a portfolio intelligence and fund management platform for VCs and private equity, combining real-time data aggregation, performance tracking, benchmarking, and automated LP reporting in one dashboard.

It provides real-time tracking of portfolio KPIs, performance benchmarking, and automated reporting to enable proactive oversight, risk detection, and LP transparency.

Primary use case: Consolidate performance, ownership, and valuation data across the portfolio to support regular monitoring, scenario planning, and LP reporting with accurate, up-to-date information.

Best for: Mid-to-large VCs and growth equity funds ($100M+ AUM)

Chronograph

Chronograph is a portfolio monitoring and intelligence platform helping investors monitor company financials, growth metrics, and operating KPIs in a unified dashboard. It provides automated, high-integrity tracking of portfolio KPIs, valuations, and trends with AI-enhanced analytics and reporting to enable proactive oversight, risk management, and transparent LP communications.

Primary use case: Track portfolio company performance in real time, benchmark results across cohorts, and centralize insights for internal reviews and LP reporting with reduced manual effort.

Best for: Mid-to-large VCs, growth equity, and institutional funds ($100M+ AUM, especially those with complex or multi-strategy portfolios)

5. Accounting and Reporting: Tools for fund financials and LP reporting

Also known as: Fund Administration, Financial Reporting, LP Reporting

Tools helping VCs handle fund accounting, prepare tax reports, generate LP statements, calculate performance metrics, and maintain compliance documentation.

Tool | key Features | Best for |

|---|---|---|

Allvue Systems | Full fund accounting (general ledger, waterfalls, carried interest, NAV, accruals), Automated LP reporting, Performance metrics calculation with real-time dashboards, Compliance & regulatory tools, Investor portal for self-service access to statements, documents, and analytics | Mid-to-large VCs, growth equity, and institutional funds ($100M+ AUM) |

ArkPES | Automated investor reporting with push-button financials and Excel exports, Comprehensive general ledger (ArkGL) purpose-built for private funds with real-time financials, automated workflows, and reconciliation, Customizable dashboards, reporting & analytics | Emerging to mid-sized VCs, private equity managers, and fund administrators ($50M–$500M+ AUM) |

Fundrbird | Automated, compliant quarterly investor reporting, Integrated general ledger with automated capital accounts and waterfalls, API support for multi-fund structures, Portfolio data aggregation with CRM and document management | Mid-sized to large European VCs and PE managers ($50M+ AUM) |

Entrilia | Real-time general ledger with private-fund-specific accruals, waterfalls, and multi-currency support, Automated capital calls & distributions, Branded LP self-service portal, Configurable quarterly & tax reporting, SOC 2 security & API integration | Emerging to mid-sized VCs and private equity managers ($50M–$500M+ AUM) |

Allvue Systems

Allvue Systems is a comprehensive fund administration and accounting platform built for private capital (VC, PE, credit, real assets), delivering integrated accounting, investor reporting, portfolio monitoring, and compliance in a single Microsoft-based ecosystem.

It can automate fund-level financials, generate accurate LP reports on demand, calculate precise performance metrics, and manage tax/compliance obligations to provide transparent investor communications.

Primary use case: End-to-end fund accounting, automated LP reporting, performance tracking, and compliance management.

Best for: Mid-to-large VCs, growth equity, and institutional funds ($100M+ AUM) requiring enterprise-grade accounting, scalable multi-fund support, and unified reporting in a Microsoft-integrated environment.

ArkPES

ArkPES is a cloud-based fund operations platform built for private capital (VC, PE, fund-of-funds, real estate), delivering integrated fund accounting, LP reporting, investor relations, and fundraising support in a configurable, intuitive system.

Primary use case: Integrated fund accounting, automated LP reporting, performance tracking, and compliance management to deliver timely, transparent financials and investor statements with high configurability.

Best for: Emerging to mid-sized VCs, private equity managers, and fund administrators ($50M–$500M+ AUM) seeking a flexible, cloud-native alternative to legacy systems with strong focus on investor experience, automation, and cost-effective scalability.

Fundrbird

FundrBird is a unified fund operations platform purpose-built for private equity and venture capital managers, consolidating fund accounting, investor reporting, portfolio data collection, KYC/AML compliance, and investor onboarding into one consistent dataset.

Primary use case: Centralized fund accounting, automated investor reporting, compliance monitoring, and portfolio data management to deliver accurate financials and professional LP communications from a single reliable system.

Best for: Mid-sized to large European VCs and PE managers ($50M+ AUM) seeking a mature, integrated alternative to fragmented legacy tools, with strong emphasis on investor reporting standards, compliance, and operational consistency (currently supports 550+ funds managing over €50B AUM).

Entrilia

Entrilia is a cloud-native fund administration combining fund accounting, investor reporting, capital calls/distributions, compliance, and LP portals in one integrated system.

Powered by automated workflows, real-time data synchronization, and configurable reporting templates, it handles general ledger, waterfalls, carried interest, NAV calculations, K-1 preparation, and multi-currency support while delivering branded, interactive investor portals.

Primary use case: Automate fund-level financials, generate accurate LP statements, process capital events, ensure regulatory compliance, and provide transparent investor communications from a single, scalable platform.

Best for: Emerging to mid-sized VCs and private equity managers ($50M–$500M+ AUM) seeking a user-friendly, cost-effective alternative to legacy systems.

6. Fund Setup/Structuring: Tools for fund formation and compliance

Also known as: Fund Formation, Legal Structuring, SPV Management, Compliance & Regulatory Setup

Tools helping VCs establish legal entities, create fund documentation, handle compliance setup, launch SPVs, and manage regulatory filings.

Tool | key Features | Best for |

|---|---|---|

Carta | SPV setup with in-app workflows, Automated KYC/AML, Support for onshore/offshore/hybrid structures, rolling funds, Integration with portfolio cap tables, valuations, and LP reporting, AI-powered monitoring, automation, and custom reporting | Emerging to mid-sized VCs ($10M–$200M+ AUM) and growth funds seeking integrated equity + fund admin |

Juniper Square | Automated investor portals, Customizable fund structures, Built-in compliance tools, Audit trails & reporting, Capital call workflows | Mid-to-large VCs and institutional funds ($100M+ AUM) |

Allocations | Instant SPV/fund setup (minutes to hours), Integrated investor portals, Capital calls/distributions, Tax coordination, End-to-end lifecycle: formation to exit/reporting | Emerging to mid-sized VCs, syndicate leads, and repeat SPV operators ($10M–$200M+ AUM) |

Sydecar | One-click SPV creation with automated legal docs, Investor onboarding portals & e-signature workflows, Built-in banking & capital call management, Integrated cap table tracking & investor reporting, Compliance automation (K-1s, tax docs, regulatory filings) | Emerging managers, syndicate leads, and repeat SPV operators ($5M–$100M+ AUM) |

AngelList | Automated legal documentation, Built-in banking, Compliance automation (KYC/AML, accreditation), Investor onboarding portals, Capital call management, Investor portals, data rooms, and ecosystem exposure for fundraising | Emerging managers, syndicate leads, and smaller-to-mid VCs ($5M–$100M+ AUM) |

Carta

Carta is a leading equity management and fund administration platform offering end-to-end fund setup and structuring services, including entity formation, legal document generation (LPA, subscription agreements), compliance setup (SEC filings, ERA registration), SPV creation, investor onboarding, and banking integration.

It supports onshore/offshore structures, rolling funds, and hybrid vehicles with automated KYC/AML, tax reporting foundations, and scalable admin tools.

Primary use case: Fast, compliant fund formation, legal structuring, SPV setup, and investor onboarding to operationalize new vehicles with minimal friction.

Best for: Emerging to mid-sized VCs ($10M–$200M+ AUM) and growth funds seeking integrated equity + fund admin, especially those already using Carta for portfolio cap tables or needing Singapore/Asia-friendly offshore options.

Juniper Square

Juniper Square is an investor relations and fund administration platform that streamlines fund setup, structuring, and ongoing LP management. It supports entity formation, legal document templates (LPA, subscription agreements), compliance workflows (KYC/AML, SEC filings support), investor onboarding, commitment tracking, and integrated banking/SPV setup.

Primary use case: Compliant fund formation, legal structuring, SPV creation, and investor onboarding to securely operationalize new funds.

Best for: Mid-to-large VCs and institutional funds ($100M+ AUM) prioritizing polished investor relations, enterprise-grade compliance, and scalable LP portals during fund setup and early fundraising.

Allocations

Allocations is a full-stack fund administration and setup platform for modern private funds (VC, PE, hybrids), enabling fast entity formation, SPV launch, legal templates, banking integration, investor onboarding, KYC/AML, compliance filings, and scalable admin.

Primary use case: Rapid, end-to-end fund formation, SPV structuring, compliance setup, and investor onboarding to operationalize vehicles scalably.

Best for: Emerging to mid-sized VCs, syndicate leads, and repeat SPV operators ($10M–$200M+ AUM) prioritizing speed, transparent pricing, full lifecycle coverage, and scalability for multiple funds/vehicles.

Sydecar

Sydecare is a deal execution and fund administration platform specializing in fast SPV and fund setup for venture investors.

It automates entity formation (Delaware Series LLC), legal documents (investment agreements, LLCA), regulatory filings (Form D, Blue Sky), instant banking, KYC/AML compliance, investor onboarding, tax prep (K-1s), and distributions.

Primary use case: Rapid SPV/fund formation, legal structuring, compliance setup, and investor onboarding.

Best for: Emerging managers, syndicate leads, and repeat SPV operators ($5M–$100M+ AUM) prioritizing speed, transparent pricing, and low-friction setup for deal-by-deal or early fund vehicles.

AngelList

AngelList is an all-in-one platform for emerging VCs for emerging VCs, offering tools for SPV launch, rolling funds, venture funds, syndicates, and back-office support via its Belltower partnership.

Primary use case: Launch funds and deal-specific SPVs quickly without traditional legal overhead, while automating compliance, investor management, and ongoing administration through a single integrated platform.

Best for: Emerging managers, syndicate leads, and smaller-to-mid VCs ($5M–$100M+ AUM) focused on rolling funds, deal-by-deal SPVs, first-time funds, or needing low-friction launch plus ecosystem advantages.

7. Fundraising: Tools for LP relationship management

Also known as: Capital Raising, LP Fundraising, Investor Relations

Tools for managing LP relationships, fundraising pipelines, data rooms, and investor communications.

Tool | key Features | Best for |

|---|---|---|

BoardEx | Relationship path mapping (coworkers, classmates, associations), Warm intro discovery, Executive profiles, Talent search (e.g., diversity filters), Private Equity Network for PE/VC firms' leadership, portfolio teams, and investment portfolios | Mid-to-large VCs and emerging managers ($50M+ AUM) |

CEPRES | Real-time portfolio monitoring with look-through analytics, Risk/return tracking, Deal-level insights, Secure data sharing between GPs/LPs for due diligence, Automated LP reporting, portfolio dashboards, and customizable analytics | Mid-to-large VCs, institutional funds, and growth equity managers ($100M+ AUM) |

Preqin | Fundraising intelligence (closed funds, timelines, investor sentiment, regional trends), Extensive LP profiles with commitment history, preferences, and contact data, Performance benchmarks, Market sizing reports, Exclusive investor surveys | Mid-to-large VCs, institutional funds, and placement agents ($100M+ AUM) |

BoardEx

BoardEx is a relationship intelligence platform mapping 1.6M+ senior executives, board members, and institutional decision-makers across public/private companies, nonprofits, and investment firms.

It reveals professional connections, shared affiliations (boards, education, employment history), family ties, and network pathways to help identify warm introduction routes to target LPs and stakeholders.

Primary use case: Relationship-driven LP sourcing and investor relations through executive network mapping, warm intro paths, and prospect research to build fundraising pipelines.

Best for: Mid-to-large VCs and emerging managers ($50M+ AUM) seeking systematic LP prospecting, particularly for institutional capital, endowments, and high-net-worth individuals, where warm intros significantly improve conversion.

CEPRES

CEPRES is the gold-standard private markets data & analytics platform, providing verified, granular insights from the world's largest LP/GP data-exchange network (covering >16,500 funds, 140,000+ deals, $72T in value, 6,000+ LPs/GPs).

Primary use case: Data-driven LP prospecting, track record benchmarking, and fundraising support via comprehensive private markets datasets, analytics, and secure GP-LP data exchange.

Best for: Mid-to-large VCs, institutional funds, and growth equity managers ($100M+ AUM) needing high-accuracy data for LP targeting, performance validation, and competitive fundraising in private markets.

Preqin

Preqin is the most authoritative private markets database and analytics provider, holding the largest verified LP/investor dataset (6,000+ LPs), detailed fundraising histories, fund performance benchmarks, and allocation patterns across PE, VC, real estate, infrastructure, and private debt.

Primary use case: LP prospecting, investor targeting, track record benchmarking, and fundraising strategy support using deep private markets data and LP intelligence.

Best for: Mid-to-large VCs, institutional funds, and placement agents ($100M+ AUM) that rely on high-quality LP intelligence, performance validation, and fundraising benchmarks.

General-Purpose Tools for VCs

8. Legal Ops: Tools for deal documentation and closing

Also known as: Deal Execution, Transaction Management, Investment Closing

Tools for streamlining legal workflows, negotiations, signatures, and final execution of investments.

Tool | key Features | Best for |

|---|---|---|

Docusign | Real-time collaboration, Redlining, Conditional logic, Mobile signing, Various compliance features (e.g., ESIGN Act, GDPR) | All VC sizes, especially emerging managers and mid-sized funds ($10M–$200M+ AUM) |

Ansarada | Drag-and-drop uploads, Granular permissions, Audit trails, AI-Smart Q&A (auto-routing/answering questions), Smart redaction, Document translation | Mid-to-large VCs and growth-stage funds ($100M+ AUM) handling complex or international deals. |

Public Comps | Instant comps tables and visualizations, Real-time multiples, Growth-adjusted valuations, Traceable sources, Historical financials with Excel/CSV export, Google Sheets/Excel plugin | Growth-stage and late-stage VCs ($100M+ AUM) writing large checks |

Agliloft | Risk detection, Obligation extraction (e.g., financial, regulatory), Enterprise-grade (GDPR, ISO 27001, audit trails, access controls), 1000+ drag-and-drop connections to business systems (CRM, ERP, e-signature, etc.) | Mid-to-large VCs and growth-stage funds ($100M+ AUM) dealing with multi-party deals |

Docusign

DocuSign is a cloud-based e-signature and agreement management platform with secure electronic signing, templates, workflow automation, audit trails, and integrations for term sheets, investment agreements, and closing documents.

It supports real-time collaboration, redlining, conditional logic, mobile signing, and compliance features (e.g., ESIGN Act, GDPR) to finalize deals quickly and legally.

Primary use case: Send, negotiate, and execute investment documents (SAFEs, convertible notes, stock purchase agreements) with minimal back-and-forth, ensuring traceable, binding closures.

Best for: All VC sizes, especially emerging managers and mid-sized funds ($10M–$200M+ AUM) seeking simple, reliable e-signatures and basic workflow automation for deal closing.

Ansarada

Ansarada is an AI-powered virtual data room (VDR) and transaction management platform for secure document sharing, due diligence, and deal execution in M&A, capital raising, and investments. It provides secure, AI-assisted deal closing and execution via controlled data rooms, streamlined Q&A, and workflow automation to finalize investments with speed and certainty.

Primary use case: Share final docs securely, handle negotiations/Q&A, track approvals, and ensure compliant execution.

Best for: Mid-to-large VCs and growth-stage funds ($100M+ AUM) handling complex or international deals.

Public Comps

Public Comps is an AI-powered valuation platform that instantly generates trading comps, transaction comps, and valuation multiples for any private company by analyzing thousands of public peers, precedents, and real-time market data.

Primary use case: Rapid public comps generation and valuation benchmarking to support pricing negotiations and final investment terms during closing.

Best for: Growth-stage and late-stage VCs ($100M+ AUM) writing large checks where rigorous, real-time public comps are expected and speed to conviction is critical.

Agliloft

Agliloft is an AI-powered, data-first contract lifecycle management (CLM) platform that automates contract creation, negotiation, redlining, approvals, execution, and obligation tracking with a no-code interface and 1000+ integrations.

It provides AI-driven CLM for negotiation, review, and closing automation to finalize investments efficiently, de-risk agreements, and handle post-closing obligations.

Primary use case: Manage investment docs (term sheets, SAFEs, equity agreements), streamline negotiations, automate approvals, and ensure compliant closing with reduced legal risk and faster execution.

Best for: Mid-to-large VCs and growth-stage funds ($100M+ AUM) dealing with sophisticated, multi-party deals.

9.Talent/Management: Tools for talent management and fund Ops

Also known as: Firm Operations, Team Management, HR & Talent, Internal Systems

Tools powering firm operations, team management, talent recruiting, and day-to-day fund administration.

Tool | key Features | Best for |

|---|---|---|

Getro | 500K+ pre-vetted candidates (former founders, operators, investors), AI-powered matching, Private job postings, Executive search, Network insights and warm referrals, Talent pipeline tools | Emerging to mid-sized VC firms ($50M–$500M AUM) and growth-stage funds |

Deel | EOR for full-time hires in 130+ countries (handles taxes, benefits, labor laws), Investor/VC partnerships for portfolio companies (discounts, dedicated support), Contractor compliance & payments, Global payroll automation, HRIS with compliance tools | Emerging to mid-sized VCs ($50M–$500M AUM) and growth-stage funds with remote teams or international portfolio companies |

Consider | AI-powered talent matching, Personalized outreach, Network mapping for warm introductions and referrals, Automated job boards for VC PortCos, Chrome extension for one-click profile addition | VC firms (emerging to mid-sized, $50M–$500M+ AUM) |

Attio | Automatic contact enrichment, Relationship mapping from email/calendar, Team collaboration with @mentions, shared inboxes, and Slack/email integrations, No-code automation for reminders, follow-ups, and data entry | Emerging to mid-sized VC firms ($50M–$500M AUM) |

Rippling | Global payroll & EOR in 100+ countries, HRIS with onboarding, performance, time/attendance, and employee self-service, IT automation, Contractor payments and misclassification protection | Emerging to mid-sized VC firms ($50M–$500M AUM) and growth-stage funds with international or remote team members |

1Password | Shared vaults and access permissions for teams, Watchtower (alerts for weak/reused passwords, breaches), Secure sharing, autofill, and emergency access, SOC 2 Type II, GDPR, HIPAA compliance | Emerging to mid-sized VC firms ($50M–$500M AUM) and growth funds needing simple, secure password/secret management |

Help Scout | Beacon (embedded chat & self-service help center), AI Summarize & Reply suggestions, Knowledge base for internal/team documentation, Saved replies, tags, workflows, and reporting | merging to mid-sized VC firms ($50M–$500M AUM) that handle high volumes of founder/LP emails |

Getro

Getro is a talent network and hiring platform built for VC and startup teams, connecting VC firms with top-tier talent (investors, operators, analysts, portfolio support) through curated networks, job postings, and personalized matching.

VCs can build and scale their internal teams, fill critical roles (e.g., associates, principals, operations), and support portfolio companies with talent introductions

Primary use case: Talent sourcing, recruitment, and team-building for VC firms and portfolio companies through curated networks, AI matching, and ecosystem referrals.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) and growth-stage funds focused on hiring high-caliber investment, operations, and portfolio-facing talent quickly.

Deel

Deel is a global payroll and HR platform enabling companies to hire, pay, and manage talent compliantly in 150+ countries without local entities via Employer of Record (EOR), Contractor Management, global payroll, PEO services, and HRIS tools.

Primary use case: Global talent acquisition, payroll, and compliance management for VC firms and portfolio companies to build distributed teams without entity setup or legal risk.

Best for: Emerging to mid-sized VCs ($50M–$500M AUM) and growth-stage funds with remote teams or international portfolio companies needing fast, compliant hiring and payroll in multiple countries.

Consider

Consider is a talent intelligence platform for VC firms and startups, aggregating networks and data (LinkedIn, GitHub, etc.) to source, match, and introduce high-quality talent for portfolio companies and internal roles.

VCs can accelerate key hires at portfolio companies, source internal team talent, and leverage ecosystem connections for efficient recruitment.

Primary use case: Talent sourcing, matching, and introductions for portfolio companies and firm roles via AI recommendations, network aggregation, and collaborative hiring workflows.

Best for: VC firms (emerging to mid-sized, $50M–$500M+ AUM) focused on portfolio acceleration through talent support, job aggregation, and ecosystem-driven hiring.

Attio

Attio is a modern, flexible CRM built for high-velocity teams like VC firms, replacing rigid traditional CRMs with a relational database that auto-syncs emails, calendars, LinkedIn, and other sources to create rich, real-time relationship profiles.

VCs can centralize LP relationship management, track fundraising outreach, log interactions, segment prospects, and maintain a living CRM of investors, founders, and ecosystem contacts without manual data entry.

Primary use case: Automated relationship tracking, LP/investor pipeline management, and personalized outreach.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) that value flexibility, real-time data sync, and minimal CRM maintenance while scaling LP relationships and fundraising efforts.

Rippling

Rippling is a unified workforce management platform that combines global payroll, HR, IT, and benefits in one system, allowing companies to hire, pay, onboard, and manage employees/contractors compliantly across countries without local entities.

It provides global payroll, HR compliance, employee onboarding, and IT management for VC firms to scale distributed teams efficiently and legally.

Primary use case: Manage global teams compliantly, handle international payroll/hiring, and offer portfolio companies discounted access via VC partnerships—simplifying operations and cutting admin overhead.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) and growth-stage funds with international or remote team members, or those supporting portfolio companies in cross-border hiring and payroll.

1Password

1Password is a secure password manager and digital vault for teams, providing end-to-end encrypted storage of passwords, API keys, SSH keys, credit cards, secure notes, and sensitive documents with zero-knowledge architecture.

Primary use case: Centralized, encrypted credential and secret management with team sharing, access controls, and compliance to protect sensitive fund and portfolio information.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) and growth funds needing simple, secure password/secret management, team-wide access governance, and compliance-ready security for internal ops and portfolio support.

Help Scout

Help Scout is a customer service and shared inbox platform designed for high-touch teams, enabling VC firms to manage internal and portfolio communications efficiently through shared email inboxes, help docs, chat, and AI-powered workflows.

VCs can centralize founder, LP, and team inquiries, provide consistent portfolio support (e.g., answering common questions via help docs), coordinate internal ops, and maintain professional communication without email chaos.

Primary use case: Streamline internal team coordination, portfolio company support, and investor communications.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) that handle high volumes of founder/LP emails and want a lightweight, collaborative tool for day-to-day operations and portfolio acceleration support.

10. Marketing: Tools for building visibility with founders and LPs

Also known as: Fundraising Marketing, LP Relations, Fund Branding

Tools helping VCs publish content, build brand visibility, and stay top-of-mind with founders and LPs.

Tool | key Features | Best for |

|---|---|---|

Mailchimp | Drag-and-drop email builder with templates (newsletters, LP updates, event invites), Automation workflows, Audience segmentation, personalization, and tagging for targeted outreach | Emerging to mid-sized VC firms ($50M–$500M AUM) looking for basic, affordable marketing automation. |

HubSpot | Drag-and-drop website builder & landing pages, Email marketing with personalization, segmentation, and automation, CRM for contact tracking, deal pipelines, and reporting, Analytics dashboards | Emerging to mid-sized VC firms ($50M–$500M AUM)looking for an all-in-one marketing and basic CRM hub. |

Figma | Real-time multiplayer editing and commenting, Smart design tools, Presentation mode for polished deck delivery, Version history, branching, and team libraries, Integrations with Slack, Google Drive, and Miro. | Emerging to mid-sized VC firms ($50M–$500M AUM) that frequently produce visual content. |

Beehiiv | Drag-and-drop editor with beautiful, mobile-optimized templates, Audience segmentation, personalization, and A/B subject-line testing, Integrations with Stripe, Google Analytics, custom domains, and Zapier | Emerging to mid-sized VC firms ($50M–$500M AUM) looking for a creator-focused, high-design newsletter tool. |

Jasper | AI writing assistant with brand voice training and templates, Long-form content generator, Blog post outlines, SEO optimization, Tone/style customization and multi-language support. | Emerging to mid-sized VC firms ($50M–$500M AUM) looking to scale content output without large in-house teams. |

Pitch | Real-time multiplayer editing with live comments and cursors, Beautiful, customizable templates, Brand kits for consistent fund visuals and fonts, Version history, branching, and export (PDF, PPT, link sharing) | Emerging to mid-sized VC firms ($50M–$500M AUM) that frequently produce presentations and similar collaterals. |

Mailchimp

Mailchimp is an all-in-one email marketing and automation platform that helps VC firms create, send, and track professional newsletters, updates, and campaigns to founders, LPs, and ecosystem contacts.

VCs can publish thought leadership content, share portfolio wins, nurture LP relationships, and stay top-of-mind through consistent, targeted emails.

Primary use case: Automated email newsletters, updates, and drip campaigns to build visibility and engagement with founders and LPs.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) needing simple, affordable tools for regular content distribution and basic marketing automation.

HubSpot

HubSpot is an all-in-one inbound marketing, sales, and CRM platform that helps VC firms attract, engage, and nurture founders, LPs, and ecosystem contacts through content, email, social, and landing pages.

Primary use case: Attract and nurture founders/LPs through content marketing, automated email sequences, social presence, and lead capture forms to boost brand visibility and inbound opportunities.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) seeking a comprehensive, user-friendly marketing hub for content distribution, email outreach, and basic CRM without needing multiple separate tools.

Figma

Figma is a collaborative interface design and prototyping tool used by VC firms to create pitch decks, fund marketing materials, brand assets, investor presentations, and visual content for founders and LPs.

VCs can quickly design professional pitch decks, LP updates, fund branding, one-pagers, event graphics, and portfolio visuals to strengthen brand perception and stay top-of-mind with founders and investors.

Primary use case: Create, iterate, and share high-quality visual content collaboratively.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) that frequently produce custom decks, marketing collateral, and visual storytelling for fundraising, LP relations, and portfolio engagement.

beehiiv

beehiiv is a modern newsletter platform allowing VC firms to publish, grow, and monetize high-quality newsletters with professional design, powerful analytics, and built-in growth tools.

Primary use case: Launch and grow professional newsletters to build visibility, nurture relationships with founders and LPs, and establish thought leadership with strong analytics and monetization options.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) looking for a creator-focused, high-design newsletter tool with built-in growth features and monetization potential beyond basic email marketing.

Jasper

Jasper is an AI-powered content creation platform that generates high-quality marketing copy, blog posts, social media content, email campaigns, pitch decks, and thought-leadership pieces tailored to VC branding and voice.

VCs can quickly produce LP newsletters, founder-facing content, fund updates, social threads, website copy, and investor pitch materials.

Primary use case: Rapid generation of branded marketing content, thought leadership, and LP/founder communications to amplify visibility and reinforce fund positioning.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) looking to scale content output without large in-house teams.

Pitch

Pitch is a collaborative presentation platform enabling VC firms to create, edit, and share stunning pitch decks, fund updates, LP reports, and marketing materials with real-time collaboration.

Build professional fundraising decks, LP updates, portfolio overviews, event slides, and founder-facing content.

Primary use case: Collaborative creation and delivery of high-impact visual content (decks, updates, marketing assets) to reinforce fund brand and engage founders/LPs effectively.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) that frequently produce and iterate on pitch decks, investor presentations, and marketing collateral.

11. Productivity & Collaboration: Tools for everyday VC operations

Also known as: Productivity Stack, Collaboration Tools, Work OS

Tools used daily by VC teams to support communication, documentation, scheduling, and collaboration, but are not VC-native systems of record.

Tool | key Features | Best for |

|---|---|---|

Miro | Infinite canvas with sticky notes, shapes, mind maps, and drawing tools, Real-time collaboration & voting, VC-specific templates (thesis maps, deal flow funnels, portfolio overviews), Video chat, timers, and facilitation tools | Emerging to mid-sized VC firms ($50M–$500M AUM) with distributed teams |

Superhuman | Split inbox & AI triage, AI writing assistant (Superhuman AI), Keyboard shortcuts, undo send, and read receipts, High-performance speed (claimed 4x faster than Gmail) | Emerging to mid-sized VC firms ($50M–$500M AUM) with high email volume. |

Loom | Instant screen + camera recording (up to 4K), AI-powered auto-editing, titles, chapters, and summaries, Loom AI for transcription, filler-word removal, and action items, Team workspaces, brand kits, and security controls | Emerging to mid-sized VC firms ($50M–$500M AUM) with distributed teams or high-touch founder/LP interactions |

SavvyCal | Personalized booking pages with branded links, Overlay multiple calendars to show true availability, Round-robin scheduling for team availability, Polling links for group coordination (e.g., founder calls, LP meetings) | Emerging to mid-sized VC firms ($50M–$500M AUM) looking for a more elegant, customizable alternative to Calendly. |

Airtable | Spreadsheet-like interface with rich fields, Custom views for deal pipelines or LP tracking, Automations & scripting for notifications, data sync, and workflows | Emerging to mid-sized VC firms ($50M–$500M AUM) that need flexible, visual data management for non-standard processes. |

Mailparser | Custom parsing rules for any email format, Automatic extraction, Forwarding rules and inbox integrations (Gmail, Outlook), Attachment handling and multi-rule setups | Emerging to mid-sized VC firms ($50M–$500M AUM) receiving high volumes of unstructured email pitches. |

Guru | AI-powered search & auto-suggestions (Guru AI), Verification workflows to keep content accurate & current, Analytics to track knowledge usage and gaps, | Emerging to mid-sized VC firms ($50M–$500M AUM) with growing teams that want a living, searchable knowledge base. |

Fireflies | Real-time transcription & speaker identification, AI summaries, Topic tracking, Action item extraction, Smart search across meetings (keywords, speakers, topics), Meeting analytics & sentiment detection | Emerging to mid-sized VC firms ($50M–$500M AUM) with high meeting volume that want to reduce note-taking time. |

Notion | All-in-one workspace for deals, memos, and firm knowledge, Flexible pages & databases, Real-time collaborative editing, Version history, permissions, and private team spaces | Emerging to mid-sized VC firms ($50M–$500M AUM) seeking a customizable, visual no-code workspace. |

Miro

Miro is an online collaborative whiteboard platform that enables VC teams to visualize ideas, run brainstorming sessions, map investment theses, create strategy boards, and facilitate remote workshops in real time.

Primary use case: Visual collaboration, brainstorming, and strategy mapping to support daily VC operations, team alignment, and creative problem-solving.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) with distributed teams that run frequent workshops, thesis sessions, or visual planning and need a flexible, visual alternative to spreadsheets or slides.

Superhuman

Superhuman is an ultra-fast, AI-powered email client built for high-performance teams, offering lightning-speed inbox management, keyboard shortcuts, AI email drafting, and intelligent triage to help VC teams process high-volume founder/LP emails efficiently.

VCs can manage founder updates, LP communications, deal follow-ups, and internal team emails quickly, reduce inbox overload, and respond professionally while staying focused on high-value work.

Primary use case: High-speed email processing, AI-assisted drafting, and inbox organization to handle daily VC communications.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) with high email volume.

Loom

Loom is a video messaging and screen-recording platform that lets VC teams create quick, asynchronous video updates, founder calls, LP reports, portfolio check-ins, and internal briefings with minimal effort.

Primary use case: Fast asynchronous video communication for founder updates, LP reporting, internal team alignment, and portfolio engagement.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) with distributed teams or high-touch founder/LP interactions that want to reduce meeting fatigue and increase clarity through short, impactful videos.

SavvyCal

SavvyCal is a modern scheduling tool that combines calendar polling, personalized booking links, and smart availability sharing, designed to make scheduling meetings effortless for busy professionals like VCs.

VCs can quickly book founder meetings, LP check-ins, internal team syncs, and portfolio calls without endless back-and-forth emails.

Primary use case: Streamline scheduling of founder calls, LP updates, team meetings, and portfolio sessions with branded, low-friction booking links and group polling.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) that schedule frequent high-touch meetings with founders, LPs, and portfolio companies and want a more elegant, customizable alternative to Calendly.

Airtable

Airtable is a flexible, no-code database and collaboration platform that combines spreadsheet simplicity with relational database power—ideal for VC teams to build custom internal tools, track deal flow, manage LP lists, organize portfolio notes, or run lightweight CRM-like systems.

VCs can create internal trackers for sourcing, diligence checklists, LP contact management, portfolio milestone tracking, or event planning.

Primary use case: Build and customize lightweight internal databases, trackers, and workflows for deal flow, LP relations, portfolio ops, and team coordination.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) that need flexible, visual data management for non-standard processes.

Mailparser

Mailparser is an email parsing and automation tool that extracts structured data from incoming emails (e.g., founder pitches, LP updates, deal alerts) and turns unstructured messages into usable database entries or triggers workflows.

Automatically parse inbound pitch emails from founders, extract key details (company name, stage, ask, links), and route them to deal trackers, Airtable bases, or Slack channels.

Primary use case: Automate extraction and routing of structured data from pitch emails, LP communications, and inbound messages to feed deal flow trackers and internal systems.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) receiving high volumes of unstructured email pitches.

Guru

Guru is a knowledge management and internal wiki platform that helps VC teams capture, organize, and share institutional knowledge, such as investment theses, deal memos, portfolio playbooks, and more, in one searchable, up-to-date hub.

Centralize firm-wide documentation, speed up onboarding, ensure process consistency, answer recurring founder/LP questions, and preserve institutional knowledge across deal cycles.

Primary use case: Capture, organize, and surface internal knowledge (theses, playbooks, processes, memos) to stay aligned.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) with growing teams that want a living, searchable knowledge base.

Fireflies

Fireflies is an AI meeting assistant that automatically records, transcribes, summarizes, and analyzes video calls (Zoom, Google Meet, Teams, etc.), extracting key insights, action items, and decisions for VC teams.

Primary use case: Automate meeting transcription, summarization, and action tracking to capture insights from founder/LP/portfolio conversations and make them searchable and actionable.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) with high meeting volume that want to reduce note-taking time, improve follow-up accuracy, and build a searchable knowledge base from calls.

Notion

Notion is an all-in-one workspace tool that combines notes, databases, wikis, tasks, and docs, allowing VC teams to build customizable internal hubs for deal flow, thesis tracking, portfolio overviews, LP updates, and team knowledge.

Primary use case: Build and maintain flexible internal hubs for deal tracking, knowledge sharing, portfolio management, and team documentation.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) seeking a customizable, visual no-code workspace for organizing information, remote collaboration, and scalable internal processes.

12. AI & Automation: Tools for AI-powered VC workflows

Also known as: AI Copilots, Workflow Automation, Agentic Tools

AI-powered tools and agents that reduce manual work across research, note-taking, scheduling, memo drafting, CRM hygiene, and data reconciliation across the VC stack.

Tool | key Features | Best for |

|---|---|---|

Yutori | Custom scout agents trained on your investment criteria, Daily/weekly scout reports with ranked opportunities, Integration with CRM (e.g., Attio, Affinity) and email | Early-stage and thesis-driven VC firms ($50M–$500M AUM) looking to scale sourcing coverage. |

DataGPT | Natural-language querying, Instant data blending from multiple sources without SQL, Predictive forecasting, Anomaly detection, Trend analysis, Secure enterprise-grade access controls, SOC 2 compliance | Mid-sized to large VC firms ($100M+ AUM) |

Zapier | 7,000+ app integrations, AI-powered Zap builder (natural-language workflow creation), Data transformation, Multi-step Zaps with conditional logic, filters, paths, and delays | Emerging to mid-sized VC firms ($50M–$500M AUM) with lean teams that rely on multiple SaaS tools |

Rows | AI Analyst for natural-language data questions & instant charts, Live data pulls, Built-in automations & JavaScript/Python steps for custom logic, Beautiful dashboards, shareable views, and embed options | Emerging to mid-sized VC firms ($50M–$500M AUM) that rely on spreadsheets but want modern features like AI querying. |

AskYourPDF | Natural-language questions, AI summaries, key point extraction, and table/chart interpretation, Multi-format support (PDF, DOCX, TXT), Secure processing, API access for automation into workflows | Early- to growth-stage VC firms ($50M–$500M AUM) handling high volumes of pitch decks and research docs. |

Wispr Flow | Real-time voice dictation with high accuracy (supports accents, jargon), Context-aware suggestions, Custom voice commands, Reusable templates, AI editing, Tone adjustment, Professional formatting | Emerging to mid-sized VC firms ($50M–$500M AUM) with heavy email/note volume |

Yutori

Yutori is an AI-powered scouting agent platform that deploys customizable autonomous agents to proactively source startups matching a VC’s thesis across the web, LinkedIn, GitHub, and other public sources.

VCs can automate thesis-aligned deal sourcing, uncover under-the-radar startups early, reduce manual research time, and keep pipelines filled without constant searching.

Primary use case: Deploy AI agents for continuous, thesis-driven startup scouting and automated early-stage outreach.

Best for: Early-stage and thesis-driven VC firms ($50M–$500M AUM) looking to scale sourcing coverage, discover hidden gems faster, and reduce manual web hunting with customizable AI scouts.

DataGPT

DataGPT is an AI-powered analytics and insights platform that turns natural-language questions into instant answers, visualizations, and reports from any connected data source (Excel, CSV, databases, BI tools, Google Sheets, Snowflake, etc.).

Primary use case: Conversational data analysis and instant visualization of portfolio metrics, fund performance, and internal data to support real-time decision-making and LP reporting.

Best for: Mid-sized to large VC firms ($100M+ AUM) seeking fast, non-technical insights, performance tracking, and ad-hoc analysis from portfolio data without heavy BI tools or SQL.

Zapier

Zapier is a no-code automation platform that connects 7,000+ apps to create workflows (Zaps), automating repetitive tasks across the VC stack without engineering.

VCs can automate CRM hygiene (e.g., PitchBook → Attio), route pitch emails (Gmail → Airtable), enrich contacts (LinkedIn → CRM), send LP reminders (Google Calendar → Slack), sync portfolio updates (Notion → email), and connect scattered tools for seamless ops.

Primary use case: No-code automation of repetitive workflows across email, CRM, databases, calendars, and communication tools.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) with lean teams that rely on multiple SaaS tools and want to automate routine tasks, data flows, and integrations without developers or custom code.

Rows

Rows is a modern spreadsheet platform with built-in AI, data connectors, and automation, combining Excel-like familiarity with powerful querying, integrations, and no-code workflows for VC teams.

VCs can build live deal trackers, LP contact lists, portfolio KPI dashboards, sourcing spreadsheets with auto-enrichment, and internal metrics views.

Primary use case: Create dynamic, connected spreadsheets with AI analysis, live data, and automation to manage deal flow, portfolio tracking, LP data, and internal reporting.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) that rely on spreadsheets but want modern features like AI querying, live integrations, and beautiful sharing without switching to rigid BI or database tools.

AskYourPDF

AskYourPDF is an AI-powered document chat tool that lets you upload PDFs (pitch decks, memos, financials, legal docs, research reports) and instantly ask questions to extract insights, summarize content, compare documents, or pull key facts.

VCs can quickly interrogate pitch decks, extract financials/terms, cross-reference memos, summarize board packs, or compare multiple founder submissions to save time during diligence.

Primary use case: Instant Q&A and summarization of uploaded documents (decks, memos, reports) to accelerate due diligence, extract insights, and reduce time spent reading lengthy files.

Best for: Early- to growth-stage VC firms ($50M–$500M AUM) handling high volumes of pitch decks and research docs.

Wispr Flow

Wispr Flow is an AI-powered voice-to-text dictation tool that enables VC teams to speak naturally and instantly generate emails, memos, notes, Slack messages, CRM entries, or investment summaries, often 3–5× faster than typing.

VCs can quickly capture post-call thoughts, draft founder replies, write diligence notes, update deal trackers, or respond to LPs on the move.

Primary use case: Voice-driven drafting and editing of emails, memos, notes, and CRM updates to speed up communication and documentation.

Best for: Emerging to mid-sized VC firms ($50M–$500M AUM) with heavy email/note volume who value speed, mobility, AI assistance, and premium dictation.

VC Tech Stack FAQs

What is the minimum tech stack a new VC fund needs to operate effectively?

At minimum, a fund will require a deal sourcing tool (Synaptic, Harmonic), deal flow CRM (Affinity, Attio), secure document storage (Google Drive, Dropbox), e-signature tool (DocuSign), and basic fund admin for compliance and LP reporting (AngelList, Carta). As for collaboration, most funds rely on tools like Slack, Notion, and Calendly.

What tools do VCs use for deal sourcing?

Modern VCs rely on a mix of tools to surface promising deals, such as Synaptic for proactive AI-driven discovery, Crunchbase or CB Insights for broad market scanning, and Affinity or Attio for relationship intelligence & warm intros.

How do VCs track portfolio companies?

Most VCs use specialized portfolio monitoring platforms (PortfolioIQ, Chronograph, Visible) that centralize KPIs, financial updates, and performance metrics in real-time dashboards.

What tools do early-stage VCs need vs. growth-stage VCs?

Early-stage VCs prioritize speed & cost: Synaptic + Attio (sourcing/CRM), Carta or Allocations (fund setup & cap tables), Visible or Fundwave (LP reporting), Notion/Airtable (ops), Superhuman + Loom (communication).

Growth-stage VCs add depth: PortfolioIQ/Standard Metrics (portfolio analytics), Ironclad/Datasite (closing), Juniper Square (LP portal), Allvue (accounting), and agentic AI (Yutori Scouts, DataGPT) for scale and institutional-grade reporting.What is the most efficient way for VC firms to produce quarterly LP reports?

Portfolio monitoring platforms (PostfolioIQ, Visible, Chronograph) are the most efficient starting point, as they track company metrics in real-time and generate quarterly LP reports automatically from live data. Funds with complex structures or 50+ LPs typically add dedicated fund admin software (Juniper Square, Allvue) for advanced calculations and regulatory filings.