Contribution Profit

Efficiency

Industry:

Sector Agnostic

Short Definition

Contribution Profit or Contribution Margin (CM) ($ value) measures the profitability of individual transactions or product lines after accounting for all variable costs—expenses that fluctuate directly with sales volume. It represents the "leftover" capital from each sale that "contributes" toward paying down fixed overhead (like rent and salaries). Once fixed costs are fully covered, every additional dollar of contribution margin flows directly to the bottom line as profit.

Short Definition

Contribution Profit or Contribution Margin (CM) ($ value) measures the profitability of individual transactions or product lines after accounting for all variable costs—expenses that fluctuate directly with sales volume. It represents the "leftover" capital from each sale that "contributes" toward paying down fixed overhead (like rent and salaries). Once fixed costs are fully covered, every additional dollar of contribution margin flows directly to the bottom line as profit.

Short Definition

Contribution Profit or Contribution Margin (CM) ($ value) measures the profitability of individual transactions or product lines after accounting for all variable costs—expenses that fluctuate directly with sales volume. It represents the "leftover" capital from each sale that "contributes" toward paying down fixed overhead (like rent and salaries). Once fixed costs are fully covered, every additional dollar of contribution margin flows directly to the bottom line as profit.

Why it matters for Investors

Unit Economics Viability: CM is the ultimate "litmus test" for a business model. If CM is negative, the company loses more money with every new customer acquired. Investors look for a positive and expanding contribution margin as proof of a scalable business.

Path to Profitability: By dividing total fixed costs by the CM per unit, investors can calculate the Break-Even Point. This tells them exactly how much volume is needed before the company becomes self-sustaining.

Variable Cost Efficiency: It exposes "hidden" leakages that Gross Margin might miss, such as high shipping costs, payment processing fees, or heavy discounting.

Operating Leverage: Companies with high contribution margins have high operating leverage; once they clear their fixed costs, their profit grows exponentially faster than their revenue.

Why it matters for Investors

Unit Economics Viability: CM is the ultimate "litmus test" for a business model. If CM is negative, the company loses more money with every new customer acquired. Investors look for a positive and expanding contribution margin as proof of a scalable business.

Path to Profitability: By dividing total fixed costs by the CM per unit, investors can calculate the Break-Even Point. This tells them exactly how much volume is needed before the company becomes self-sustaining.

Variable Cost Efficiency: It exposes "hidden" leakages that Gross Margin might miss, such as high shipping costs, payment processing fees, or heavy discounting.

Operating Leverage: Companies with high contribution margins have high operating leverage; once they clear their fixed costs, their profit grows exponentially faster than their revenue.

Why it matters for Investors

Unit Economics Viability: CM is the ultimate "litmus test" for a business model. If CM is negative, the company loses more money with every new customer acquired. Investors look for a positive and expanding contribution margin as proof of a scalable business.

Path to Profitability: By dividing total fixed costs by the CM per unit, investors can calculate the Break-Even Point. This tells them exactly how much volume is needed before the company becomes self-sustaining.

Variable Cost Efficiency: It exposes "hidden" leakages that Gross Margin might miss, such as high shipping costs, payment processing fees, or heavy discounting.

Operating Leverage: Companies with high contribution margins have high operating leverage; once they clear their fixed costs, their profit grows exponentially faster than their revenue.

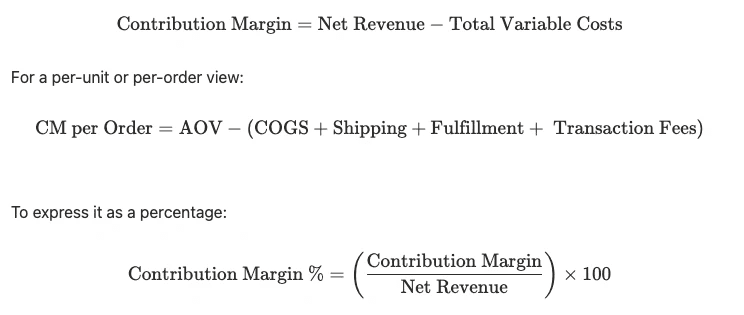

Formula

COGS is Cost of Goods Sold (the direct cost of producing or buying the inventory), and AOV is Average Order Value

Practical considerations:

Variable Cost Scope: Be rigorous. Include payment gateway fees, packaging, delivery/last-mile logistics, pick-and-pack fulfillment, and sales commissions.

Discounts & Returns: Always calculate CM using Net Revenue (Gross Sales minus discounts and returns) to avoid overstating the margin.

CM Layers (CM1, CM2, CM3): Many startups report in "tiers." CM1 (Revenue - COGS), CM2 (CM1 - Logistics/Fulfillment), and CM3 (CM2 - Variable Marketing). Investors often focus on CM2 to see "Operational Contribution" and CM3 to see "Marketing Contribution."

Marketing Spend: Traditional CM excludes marketing, but in many modern DTC/ Marketplace models, variable ad spend per order is treated as a variable cost to show the "true" contribution after acquisition.

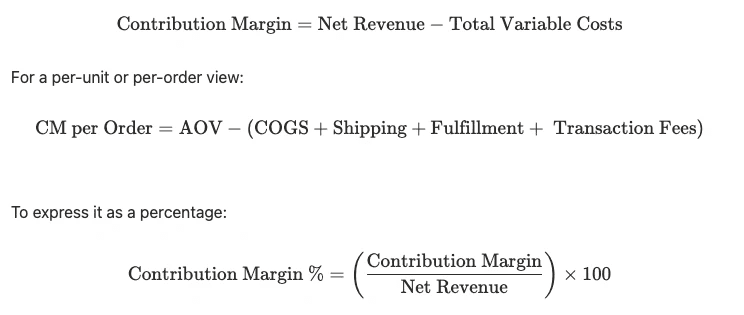

Formula

COGS is Cost of Goods Sold (the direct cost of producing or buying the inventory), and AOV is Average Order Value

Practical considerations:

Variable Cost Scope: Be rigorous. Include payment gateway fees, packaging, delivery/last-mile logistics, pick-and-pack fulfillment, and sales commissions.

Discounts & Returns: Always calculate CM using Net Revenue (Gross Sales minus discounts and returns) to avoid overstating the margin.

CM Layers (CM1, CM2, CM3): Many startups report in "tiers." CM1 (Revenue - COGS), CM2 (CM1 - Logistics/Fulfillment), and CM3 (CM2 - Variable Marketing). Investors often focus on CM2 to see "Operational Contribution" and CM3 to see "Marketing Contribution."

Marketing Spend: Traditional CM excludes marketing, but in many modern DTC/ Marketplace models, variable ad spend per order is treated as a variable cost to show the "true" contribution after acquisition.

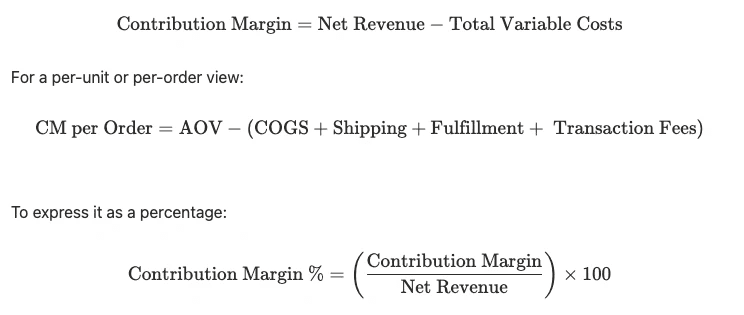

Formula

COGS is Cost of Goods Sold (the direct cost of producing or buying the inventory), and AOV is Average Order Value

Practical considerations:

Variable Cost Scope: Be rigorous. Include payment gateway fees, packaging, delivery/last-mile logistics, pick-and-pack fulfillment, and sales commissions.

Discounts & Returns: Always calculate CM using Net Revenue (Gross Sales minus discounts and returns) to avoid overstating the margin.

CM Layers (CM1, CM2, CM3): Many startups report in "tiers." CM1 (Revenue - COGS), CM2 (CM1 - Logistics/Fulfillment), and CM3 (CM2 - Variable Marketing). Investors often focus on CM2 to see "Operational Contribution" and CM3 to see "Marketing Contribution."

Marketing Spend: Traditional CM excludes marketing, but in many modern DTC/ Marketplace models, variable ad spend per order is treated as a variable cost to show the "true" contribution after acquisition.

Worked Example

Line Item | Value (per Order) | Description |

|---|---|---|

Gross Order Value | $100.00 | Initial price paid by customer |

Discounts / Promo Codes | ($10.00) | Subtracted to get Net Revenue |

Net Revenue | $90.00 | Starting point for contribution margin |

Cost of Goods Sold (COGS) | ($40.00) | Product manufacturing or purchase cost |

Shipping & Packaging | ($8.00) | Warehouse to customer doorstep |

Transaction Fees | ($2.70) | Payment processor fees (e.g., ~3%) |

Fulfillment / Labor | ($4.30) | Pick-and-pack variable labor |

Contribution Margin ($) | $35.00 | Funds available for fixed costs and profit |

Contribution Margin (%) | 38.9% | $35 ÷ $90 |

Notes:

CM vs. Gross Margin: In traditional accounting, Gross Margin often only includes COGS. Contribution Margin is more "honest" for operators because it includes every cent spent to actually fulfill the order (delivery, packaging, fees).

Negative CM Strategy: Startups sometimes tolerate negative CM during "blitzscaling" (e.g., heavy subsidies in food delivery) to gain market share, but investors in 2026 generally demand a clear, time-bound bridge to positive CM.

Sensitivity: A small 5% increase in shipping rates or a 2% increase in credit card fees can have a massive "multiplier effect," potentially wiping out 20% of the total contribution margin.

Worked Example

Line Item | Value (per Order) | Description |

|---|---|---|

Gross Order Value | $100.00 | Initial price paid by customer |

Discounts / Promo Codes | ($10.00) | Subtracted to get Net Revenue |

Net Revenue | $90.00 | Starting point for contribution margin |

Cost of Goods Sold (COGS) | ($40.00) | Product manufacturing or purchase cost |

Shipping & Packaging | ($8.00) | Warehouse to customer doorstep |

Transaction Fees | ($2.70) | Payment processor fees (e.g., ~3%) |

Fulfillment / Labor | ($4.30) | Pick-and-pack variable labor |

Contribution Margin ($) | $35.00 | Funds available for fixed costs and profit |

Contribution Margin (%) | 38.9% | $35 ÷ $90 |

Notes:

CM vs. Gross Margin: In traditional accounting, Gross Margin often only includes COGS. Contribution Margin is more "honest" for operators because it includes every cent spent to actually fulfill the order (delivery, packaging, fees).

Negative CM Strategy: Startups sometimes tolerate negative CM during "blitzscaling" (e.g., heavy subsidies in food delivery) to gain market share, but investors in 2026 generally demand a clear, time-bound bridge to positive CM.

Sensitivity: A small 5% increase in shipping rates or a 2% increase in credit card fees can have a massive "multiplier effect," potentially wiping out 20% of the total contribution margin.

Worked Example

Line Item | Value (per Order) | Description |

|---|---|---|

Gross Order Value | $100.00 | Initial price paid by customer |

Discounts / Promo Codes | ($10.00) | Subtracted to get Net Revenue |

Net Revenue | $90.00 | Starting point for contribution margin |

Cost of Goods Sold (COGS) | ($40.00) | Product manufacturing or purchase cost |

Shipping & Packaging | ($8.00) | Warehouse to customer doorstep |

Transaction Fees | ($2.70) | Payment processor fees (e.g., ~3%) |

Fulfillment / Labor | ($4.30) | Pick-and-pack variable labor |

Contribution Margin ($) | $35.00 | Funds available for fixed costs and profit |

Contribution Margin (%) | 38.9% | $35 ÷ $90 |

Notes:

CM vs. Gross Margin: In traditional accounting, Gross Margin often only includes COGS. Contribution Margin is more "honest" for operators because it includes every cent spent to actually fulfill the order (delivery, packaging, fees).

Negative CM Strategy: Startups sometimes tolerate negative CM during "blitzscaling" (e.g., heavy subsidies in food delivery) to gain market share, but investors in 2026 generally demand a clear, time-bound bridge to positive CM.

Sensitivity: A small 5% increase in shipping rates or a 2% increase in credit card fees can have a massive "multiplier effect," potentially wiping out 20% of the total contribution margin.

Best Practices

Segment by Channel: Track CM by acquisition channel (e.g., Instagram vs. Search). Often, high-revenue channels have such high variable marketing costs that their CM is actually lower than smaller "organic" channels.

Monitor "The Gap": Watch the spread between Gross Margin and Contribution Margin. If the gap is widening, your logistics or payment costs are scaling faster than your revenue.

Automate Variable Tagging: Ensure your accounting software tags costs as "variable" or "fixed" at the point of entry to allow for real-time CM dashboards.

Best Practices

Segment by Channel: Track CM by acquisition channel (e.g., Instagram vs. Search). Often, high-revenue channels have such high variable marketing costs that their CM is actually lower than smaller "organic" channels.

Monitor "The Gap": Watch the spread between Gross Margin and Contribution Margin. If the gap is widening, your logistics or payment costs are scaling faster than your revenue.

Automate Variable Tagging: Ensure your accounting software tags costs as "variable" or "fixed" at the point of entry to allow for real-time CM dashboards.

Best Practices

Segment by Channel: Track CM by acquisition channel (e.g., Instagram vs. Search). Often, high-revenue channels have such high variable marketing costs that their CM is actually lower than smaller "organic" channels.

Monitor "The Gap": Watch the spread between Gross Margin and Contribution Margin. If the gap is widening, your logistics or payment costs are scaling faster than your revenue.

Automate Variable Tagging: Ensure your accounting software tags costs as "variable" or "fixed" at the point of entry to allow for real-time CM dashboards.

FAQs

Can Contribution Margin be higher than Gross Margin?

No. Because Contribution Margin subtracts more costs (it includes all variable costs, not just COGS), it will almost always be lower than Gross Margin.Should I include salaries in Contribution Margin?

No. Salaries are typically fixed costs (they don't change if you sell 1 extra unit today). However, if you hire temp workers specifically to pack boxes per order, that is a variable cost.

FAQs

Can Contribution Margin be higher than Gross Margin?

No. Because Contribution Margin subtracts more costs (it includes all variable costs, not just COGS), it will almost always be lower than Gross Margin.Should I include salaries in Contribution Margin?

No. Salaries are typically fixed costs (they don't change if you sell 1 extra unit today). However, if you hire temp workers specifically to pack boxes per order, that is a variable cost.

FAQs

Can Contribution Margin be higher than Gross Margin?

No. Because Contribution Margin subtracts more costs (it includes all variable costs, not just COGS), it will almost always be lower than Gross Margin.Should I include salaries in Contribution Margin?

No. Salaries are typically fixed costs (they don't change if you sell 1 extra unit today). However, if you hire temp workers specifically to pack boxes per order, that is a variable cost.

Related Metrics

Commonly mistaken for:

Gross Margin (Gross Margin typically only deducts the COGS. Contribution Margin is more rigorous all variable costs)

Operating Margin ( This subtracts both variable costs and fixed operating expenses (like rent, R&D, and executive salaries) from revenue. Contribution Margin only looks at the profit of the next unit sold, whereas Operating Margin looks at the profit of the entire business entity after all bills are paid)

Related Metrics

Commonly mistaken for:

Gross Margin (Gross Margin typically only deducts the COGS. Contribution Margin is more rigorous all variable costs)

Operating Margin ( This subtracts both variable costs and fixed operating expenses (like rent, R&D, and executive salaries) from revenue. Contribution Margin only looks at the profit of the next unit sold, whereas Operating Margin looks at the profit of the entire business entity after all bills are paid)

Related Metrics

Commonly mistaken for:

Gross Margin (Gross Margin typically only deducts the COGS. Contribution Margin is more rigorous all variable costs)

Operating Margin ( This subtracts both variable costs and fixed operating expenses (like rent, R&D, and executive salaries) from revenue. Contribution Margin only looks at the profit of the next unit sold, whereas Operating Margin looks at the profit of the entire business entity after all bills are paid)

Components:

Index