Non-Current Liabilities

Financials

Industry:

Sector Agnostic

Short Definition

Non-current liabilities (long-term liabilities) are obligations the company does not expect to settle within 12 months (or the operating cycle, if longer). Think long-term debt, lease liabilities (non-current portion), deferred tax liabilities, long-term provisions, pensions, and deferred revenue due after a year.

Why it matters for Investors

Capital structure insight: Shows how the business is financed — through long‑term debt versus equity — helping assess leverage and solvency.

Cash flow implications: Large non‑current liabilities mean future cash outflows for repayments or interest, affecting free cash flow forecasts.

Growth vs. risk balance: Moderate long‑term borrowing can fund expansion efficiently; excessive long‑term debt raises financial risk and reduces flexibility.

Valuation signal: Included in Enterprise Value and leverage ratios (e.g., Debt/EBITDA).

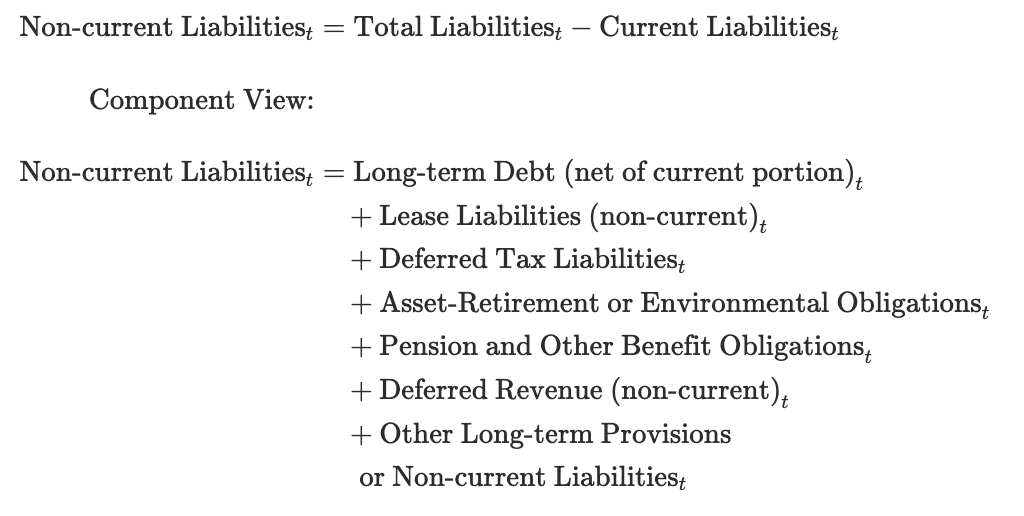

Formula

Practical considerations:

12‑month rule (simple view): Anything a company doesn’t have to repay or settle in the next 12 months — or within its standard operating cycle (if longer) — counts as non‑current. Think of it as “future obligations beyond the near term.”

Current portion of long‑term debt: Always split long‑term borrowings into two parts: the next 12 months of principal (current) and the rest (non‑current). This gives a clear picture of short‑term cash commitments vs. long‑term leverage.

Refinancing or covenant issues:

If loans are about to breach covenants or fall due, check whether the company can legally defer payment.

Under both IFRS and US GAAP, keeping a loan classified as "non‑current" depends on having a formal right or agreement to defer at the reporting date — not just a post‑period conversation.

For investors, this affects how secure the debt structure really is — last‑minute waivers often signal stress.

Leases (new‑standard reality): Every lease now sits on the balance sheet.

The current portion = lease payments due in the next year.

The non‑current portion = everything after that.

This helps investors see the true debt‑like nature of leases.

Deferred taxes: Most deferred tax liabilities (DTLs) are automatically non‑current — they’re timing differences that unwind over several years. Treat them as future, not imminent, tax obligations.

Deferred or long‑dated revenue: If customers pay for goods/services the company will deliver after 12 months, classify it as non‑current deferred revenue. For example: a 3‑year prepaid software contract — the last two years’ revenue sits in non‑current deferred revenue.

Contingent liabilities & provisions: Record only when there’s a probable and measurable future outflow (lawsuits, warranties, etc.). Split them into current/non‑current based on expected timing of settlement. This shows investors possible future claims on cash.

Discounted obligations: Some long‑term items (like asset‑retirement or environmental obligations) are present‑valued and accrete over time. Ensure your accounting policy updates the split correctly between current and non‑current portions — it helps investors avoid underestimating long‑term liabilities.

Consistency & transparency: Apply the same classification rules each period and clearly show major components of non‑current liabilities (e.g., “Long‑term Debt,” “Leases,” “Deferred Taxes,” etc.). Consistent labeling builds data reliability for trend and ratio analysis.

Worked Example

Non-Current Liability Item | Amount | What It Represents |

|---|---|---|

Long-term debt (net of current portion) | $14,500,000 | Loans or credit facilities due beyond 12 months |

Lease liabilities (non-current) | $2,900,000 | Office, equipment, or data-center leases beyond next year |

Deferred tax liabilities | $1,200,000 | Future taxes from timing differences (e.g., depreciation) |

Long-term deferred revenue | $1,100,000 | Customer prepayments for products/services to be delivered after 12 months |

Provisions (warranty / Asset Retirement Obligation / legal) | $600,000 | Expected long-term payouts for guarantees, environmental, or legal claims |

Pension Obligations & Other Post-Employment Benefits | $450,000 | Long-term employee benefit and retirement commitments |

Contingent consideration (acquisition) | $300,000 | Future payments tied to acquisition milestones or performance targets |

Total Non-Current Liabilities | $21,050,000 | Long-term obligations extending beyond the next 12 months |

Notes:

Snapshot meaning: The company has $21.05 M in long‑term obligations — commitments beyond the coming year. For investors, this defines future cash outflows and leverage risk; for founders, it shows how much financing runway is already locked in.

Debt mix: Long‑term borrowing of $14.5 M is the biggest component — that’s your strategic financing pool, not an immediate cash drain. Make sure repayment schedules align with expected growth or asset lifecycles.

Leases as hidden debt: The $2.9 M in leases acts like financing; it represents long‑term use of assets (offices, warehouses, or equipment). Treat it like debt when tracking leverage or burn.

Deferred revenue clarity: $1.1 M reflects customer cash already collected for services you’ll deliver later — effectively customer‑funded working capital. Investors like this because it reduces external funding needs.

Deferred taxes & provisions: These are future accounting obligations, not immediate cash hits — but they still show up in long‑term liabilities to highlight timing or risk exposures.

Watch for reclassification triggers:

If a loan covenant is breached and the lender can demand payment now, that portion must move to current liabilities unless a waiver is secured before period‑end.

This matters for runway optics — sudden reclassification can make liquidity look tighter overnight.

What to monitor:

Ratio of Non‑current Liabilities / Total Assets → balance-sheet leverage.

Interest Coverage (EBIT / Interest) → repayment comfort.

Trend over time — rising long‑term debt is fine if matched by asset or ARR growth.

Best Practices

Monitor leverage: Track the ratio of Non‑Current Liabilities to Total Assets or Equity (Debt‑to‑Equity) to gauge financial risk.

Balance maturity: Aim for a mix of short‑ and long‑term debt that aligns with asset life and growth plans.

Disclose clearly: Break down major liability categories to improve transparency for lenders and investors.

Trend analysis: Evaluate movements across reporting periods — sudden increases may reflect refinancing or new capital structures.

Pair with: Interest Coverage Ratio, Debt‑to‑Equity, and Net Debt / EBITDA for full leverage assessment.

FAQs

What’s the difference between current and non‑current liabilities?

Current liabilities are due within 12 months (e.g., accounts payable, short‑term loans). Non‑current liabilities are obligations due after that period — they represent long‑term financing commitments.Do all companies have non‑current liabilities?

Most do, though amounts vary. Asset‑heavy industries (e.g., manufacturing, energy) tend to rely more on long‑term debt than asset‑light startups.Why do investors care about long‑term liabilities if they’re not due soon?

They affect future cash flows, interest expense, and creditworthiness — key inputs into valuation and risk assessment.Can non‑current liabilities be positive for growth?

Yes — using longer‑term debt to fund productive assets can enhance returns, as long as operating cash flow comfortably covers repayment obligations.

Related Metrics

Commonly mistaken for:

Current liabilities (timing cutoff differs)

Total Debt (Includes both short‑ and long‑term borrowings; non‑current liabilities capture only the long‑term portion)

Source of: