Free Cash Flow

Financials

Liquidity

Industry:

Sector Agnostic

Short Definition

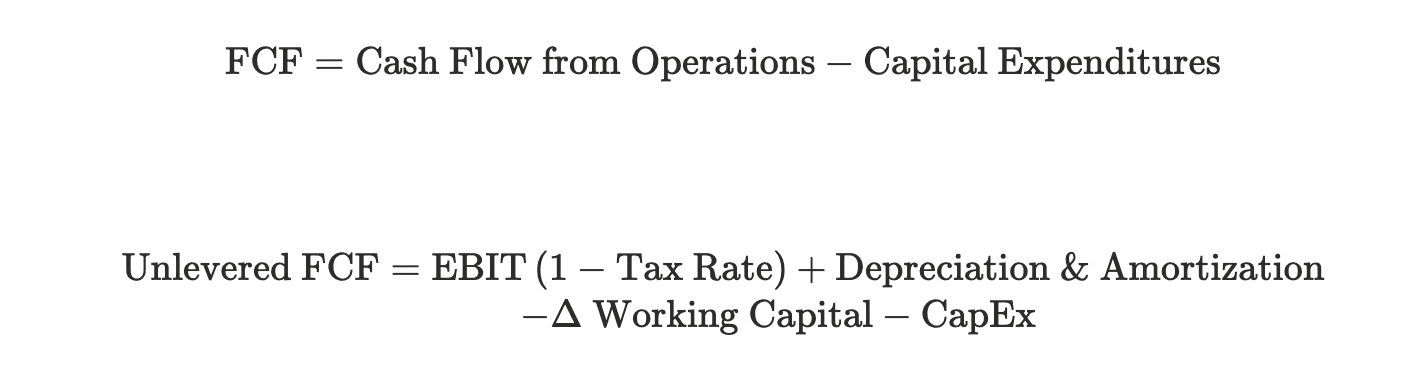

Free Cash Flow (FCF) is the cash generated from core operations after funding capital expenditures (CapEx). It shows how much cash is truly available to reinvest in growth, pay down debt, or return to shareholders. It’s the cleanest measure of a company’s ability to turn profit into cash.

Why it matters for Investors

Cash reality check: Cuts through accounting noise; shows real liquidity creation.

Capital flexibility: Cash left after CapEx funds M&A, debt repayment, and optionality.

Efficiency signal: Strong FCF with healthy growth indicates durable unit economics.

Worked Example

Line Item (Last 12 Months) | Amount | Notes |

|---|---|---|

Cash Flow from Operations (CFO) | $8,400,000 | From the cash-flow statement; includes working capital |

Capital Expenditures (CapEx) | $(3,200,000) | PP&E and capitalized software spend |

Free Cash Flow (FCF) | $5,200,000 | CFO − CapEx |

Revenue | $52,000,000 | For margin calculation |

FCF Margin (%) | 10.0% | ($5.2M ÷ $52.0M) × 100 |

Notes:

Start from CFO: Operating cash flow already reflects net income, non-cash charges (Depreciation & Amortization expenses, Stock-based compensation expenses), and working-capital changes.

Subtract CapEx: Only spending that creates or upgrades long-term assets (equipment, software, infrastructure).

FCF = Cash available: After reinvestment, this is the cash left for shareholders or lenders.

Interpretation: Positive FCF means the business is self-funding; negative FCF can be acceptable if driven by deliberate growth investments.

Best Practices

Reconcile visibly: Publish a CFO → FCF bridge to make CapEx clear.

Show both $ and %: Use FCF in absolute terms and as a margin on revenue.

Clarify CapEx policy: Specify if software capitalization or lease principal is included.

Add context: Present FCF alongside Burn Multiple, Rule of 40 %, and Cash Runway for a complete picture.

Segment when relevant: Split by region or product to spot areas draining or generating cash.

Smooth volatility: Use trailing-twelve-month (TTM) FCF for trend analysis.

FAQs

FCF quality red flags?

Under-invested CapEx, big one-off cash boosts, aggressive working-capital pulls, or sudden spikes in capitalized costs.Does FCF include stock comp?

Yes—stock comp is non-cash in CFO; FCF uses reported CFO (which already includes it).Does FCF include asset sale proceeds?

Usually no (use CapEx purchases only). If you net proceeds, disclose and keep consistent.What’s the difference vs. Operating Cash Flow?

Operating Cash Flow is before CapEx; FCF = CFO − CapEx.Unlevered vs. levered FCF?

Standard FCF above is to the firm (unlevered). FCFE (to equity) also subtracts net debt changes—label clearly if you use it.Can negative FCF be Ok?

Yes, for high-growth phases—if unit economics are solid and the Burn Multiple is improving.

Related Metrics

Commonly mistaken for:

Operating Cash Flow (Before CapEx)

EBITDA (Non-cash, pre-working-capital; not cash)

Source of: