Capital Expenditures

Financials

Industry:

Sector Agnostic

Short Definition

Capital Expenditures (Capex) refer to the capital used by a company to acquire, upgrade, or maintain physical assets (e.g., property, plant, equipment) or intangible assets (e.g., patents, software) that will provide long-term benefits. It is a key metric reflecting investment in assets to support future growth and operations.

Why it matters for Investors

Runway and cash planning: CapEx is a direct cash outflow that reduces available runway, even if it doesn’t hit the income statement immediately.

Signal of scaling infrastructure: Rising CapEx often means the company is investing ahead of growth—servers, data centers, R&D equipment, or facilities.

Quality of growth: Moderate, targeted CapEx indicates disciplined scaling; excessive CapEx can hint at capital-intensive or low-margin models.

Free Cash Flow driver: CapEx is subtracted from Cash Flow from Operations to calculate Free Cash Flow (FCF = CFO – CapEx).

Valuation implication: Low-CapEx business models typically trade at higher multiples because they convert revenue into cash more efficiently.

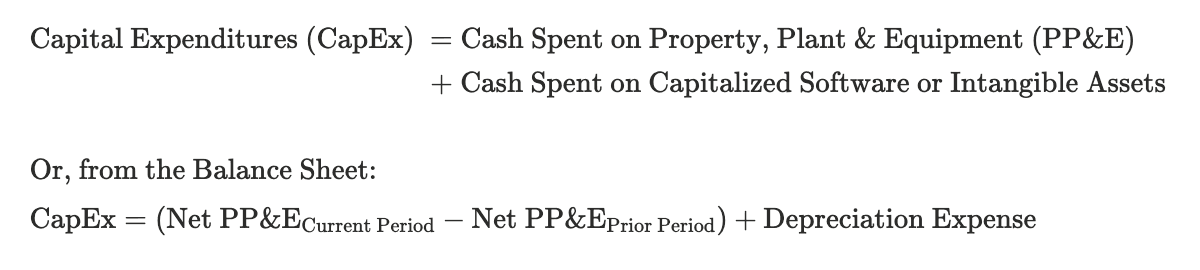

Formula

Practical considerations:

Classification: CapEx is recorded as an asset purchase, not an expense. It’s depreciated (tangible) or amortized (intangible) over its useful life.

Intangibles: Include internally developed software costs that meet capitalization criteria under GAAP/IFRS.

Exclusions: Exclude routine operating costs like rent, maintenance, or small equipment below capitalization threshold.

Cash flow presentation: Shown under Cash Flow from Investing Activities (CFI) as “Purchases of Property and Equipment.”

CapEx vs. OpEx: CapEx improves capacity; OpEx runs daily operations. SaaS founders often confuse capitalized R&D with OpEx—keep them separate.

Timing: Use the payment or acquisition date, not delivery completion.

Worked Example

Line Item | Amount | Notes |

|---|---|---|

Office Build-out Costs | $250,000 | Leasehold improvements capitalized |

Servers & Equipment | $150,000 | Data center hardware |

Capitalized Software Development | $100,000 | Meets GAAP criteria for capitalization |

Computer Hardware | $50,000 | Laptops for new hires (capitalized above policy threshold) |

Total CapEx = $550,000

Notes:

In the cash flow statement: CapEx = $550 K (outflow under CFI), Depreciation = $110 K (expense under OpEx). Free Cash Flow = CFO – CapEx

Best Practices

Set a capitalization policy: Define minimum value and useful life thresholds (e.g., >$5 K and >1 year).

Separate maintenance from growth CapEx: Track how much spend is for keeping systems running vs. expanding capacity.

Budget for cash impact: Even profitable companies can burn cash if CapEx is front-loaded.

Depreciation alignment: Match asset life to reality (servers ~3 yrs, office fit-outs ~5 yrs).

CapEx intensity ratio: CapEx / Revenue shows capital requirements for growth—lower is better for software businesses.

FAQs

What counts as CapEx?

Any spend to buy or upgrade long-term assets—property, equipment, or capitalized software—that benefit future periods.Is CapEx an expense?

Not immediately. It’s capitalized as an asset and expensed gradually through depreciation or amortization.Where does CapEx show up in financials?

On the Balance Sheet as PP&E (or intangible assets), and in the Cash Flow Statement under Investing Activities as a cash outflow.What’s the difference between CapEx and OpEx?

CapEx builds or improves long-term assets; OpEx keeps the business running day-to-day. CapEx → Balance Sheet → Depreciation over time. OpEx → Income Statement → Immediate expense.Can CapEx decrease?

Yes — in lean periods, companies defer infrastructure or hardware upgrades to preserve cash.Do software companies have CapEx?

Yes — usually for capitalized software development, office build-outs, and hardware. They just tend to be low CapEx relative to revenue.

Related Metrics

Commonly mistaken for:

Operating Expenses (Short-term operational costs)

Capitalized Interest (Interest costs included in asset value)

Total Expenditures (Includes non-capital costs)