Cash & Cash Equivalents

Financials

Liquidity

Industry:

Sector Agnostic

Short Definition

Cash and Cash Equivalents is the total value of a company’s most liquid assets, including physical cash, bank deposits, and short-term investments that can be quickly converted to known amounts of cash—typically within 90 days—with minimal risk of loss in value. It answers the question: “How much immediate spending power does the company have?”

Short Definition

Cash and Cash Equivalents is the total value of a company’s most liquid assets, including physical cash, bank deposits, and short-term investments that can be quickly converted to known amounts of cash—typically within 90 days—with minimal risk of loss in value. It answers the question: “How much immediate spending power does the company have?”

Short Definition

Cash and Cash Equivalents is the total value of a company’s most liquid assets, including physical cash, bank deposits, and short-term investments that can be quickly converted to known amounts of cash—typically within 90 days—with minimal risk of loss in value. It answers the question: “How much immediate spending power does the company have?”

Why it matters for Investors

Liquidity measure: Indicates the company’s ability to meet short-term financial obligations without needing to sell long-term assets or raise debt.

Runway indicator: For startups, cash and equivalents show how long the company can sustain operations before needing additional funding or revenue.

Resilience signal: Higher cash balances provide a cushion against unforeseen expenses, economic downturns, or investment opportunities.

Valuation driver: Strong cash positions can improve valuation multiples and investor confidence, reflecting financial stability and flexibility.

Why it matters for Investors

Liquidity measure: Indicates the company’s ability to meet short-term financial obligations without needing to sell long-term assets or raise debt.

Runway indicator: For startups, cash and equivalents show how long the company can sustain operations before needing additional funding or revenue.

Resilience signal: Higher cash balances provide a cushion against unforeseen expenses, economic downturns, or investment opportunities.

Valuation driver: Strong cash positions can improve valuation multiples and investor confidence, reflecting financial stability and flexibility.

Why it matters for Investors

Liquidity measure: Indicates the company’s ability to meet short-term financial obligations without needing to sell long-term assets or raise debt.

Runway indicator: For startups, cash and equivalents show how long the company can sustain operations before needing additional funding or revenue.

Resilience signal: Higher cash balances provide a cushion against unforeseen expenses, economic downturns, or investment opportunities.

Valuation driver: Strong cash positions can improve valuation multiples and investor confidence, reflecting financial stability and flexibility.

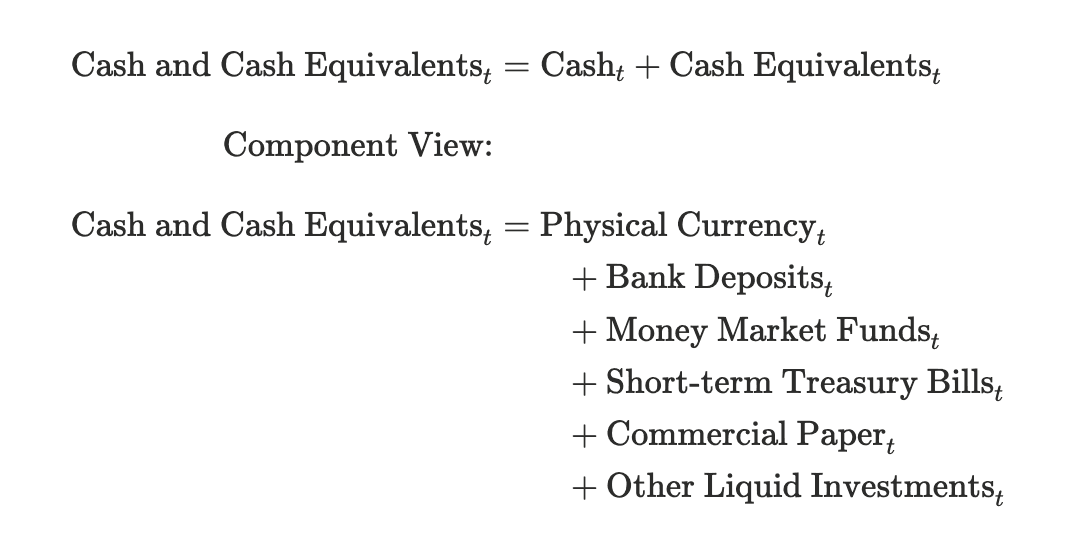

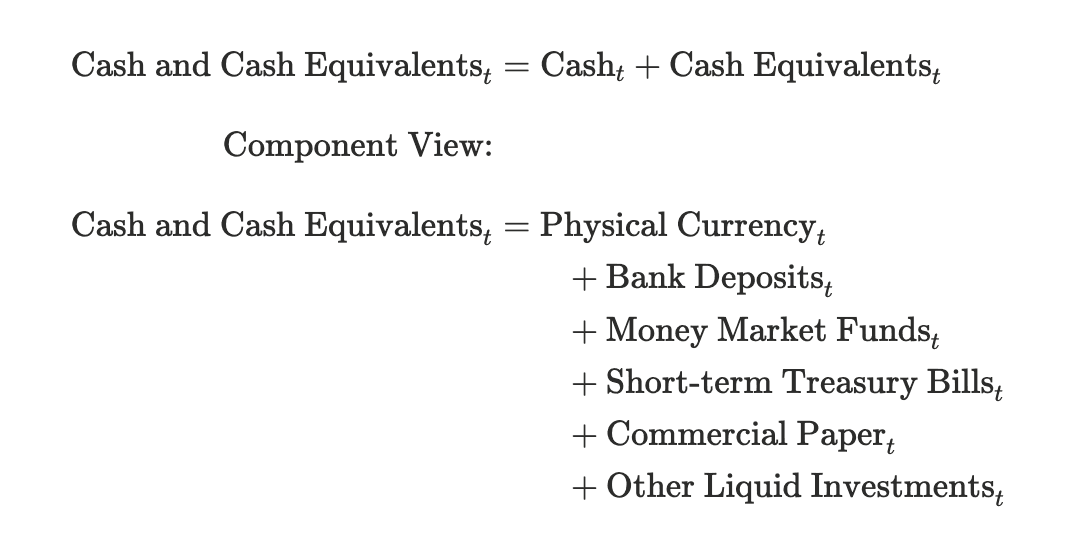

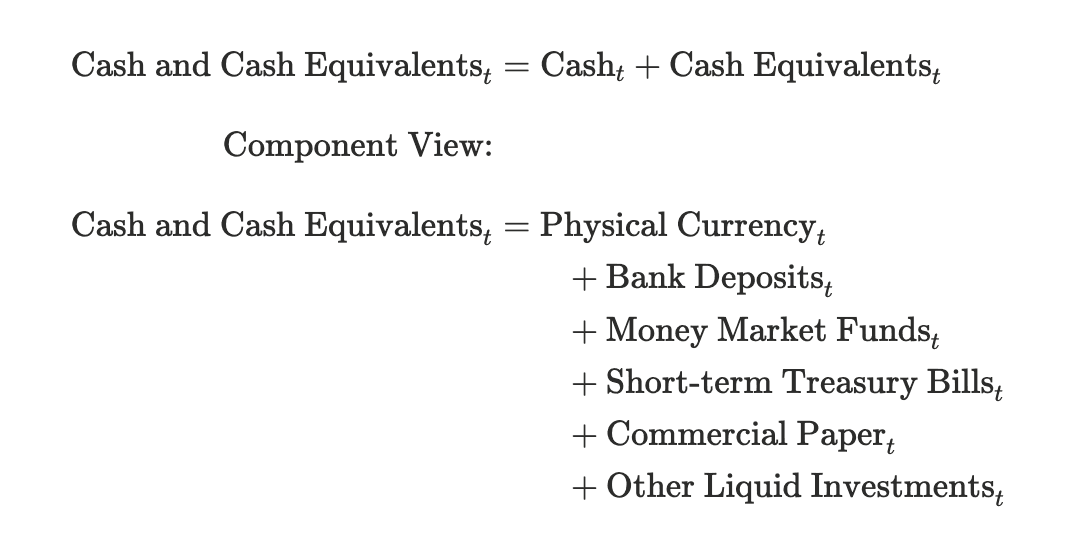

Formula

Practical considerations:

Maturity threshold: Include only investments maturing in 90 days or less from acquisition date.

Risk assessment: Equivalents must have negligible risk of principal loss; exclude volatile assets like stocks.

Currency conversion: Report in reporting currency (e.g., USD), using spot rates for foreign holdings.

Restricted cash: Exclude amounts not available for general use (e.g., escrows, collateral).

Audit trail: Maintain bank statements and investment records for verification under GAAP/IFRS.

Non-cash items: Do not include accounts receivable, even if collectible soon.

Formula

Practical considerations:

Maturity threshold: Include only investments maturing in 90 days or less from acquisition date.

Risk assessment: Equivalents must have negligible risk of principal loss; exclude volatile assets like stocks.

Currency conversion: Report in reporting currency (e.g., USD), using spot rates for foreign holdings.

Restricted cash: Exclude amounts not available for general use (e.g., escrows, collateral).

Audit trail: Maintain bank statements and investment records for verification under GAAP/IFRS.

Non-cash items: Do not include accounts receivable, even if collectible soon.

Formula

Practical considerations:

Maturity threshold: Include only investments maturing in 90 days or less from acquisition date.

Risk assessment: Equivalents must have negligible risk of principal loss; exclude volatile assets like stocks.

Currency conversion: Report in reporting currency (e.g., USD), using spot rates for foreign holdings.

Restricted cash: Exclude amounts not available for general use (e.g., escrows, collateral).

Audit trail: Maintain bank statements and investment records for verification under GAAP/IFRS.

Non-cash items: Do not include accounts receivable, even if collectible soon.

Worked Example

Line item | Value | Notes |

|---|---|---|

Physical Currency | $50,000 | Cash on hand |

Bank Deposits | $1,200,000 | Checking and savings accounts |

Money Market Funds | $300,000 | Highly liquid, low-risk |

Short-Term Treasury Bills | $450,000 | Maturing in 60 days |

|

| Sum of above |

Cash and Cash Equivalents = Cash + Cash Equivalents = (50,000 + 1,200,000) + (300,000 + 450,000) = 2,000,000

Cash = Physical Currency + Bank Deposits = 50,000 + 1,200,000 = 1,250,000

Cash Equivalents = Money Market Funds + Short-term Treasury Bills = 300,000 + 450,000 = 750,000

Notes:

90-day rule: All equivalents must convert to cash within 90 days without significant value risk.

Exclude illiquids: No stocks, bonds over 90 days, or restricted funds.

Reporting currency: Convert foreign cash at current exchange rates.

GAAP/IFRS accounting standards compliance: Classify based on intent and ability to liquidate quickly.

Overdraft treatment: Net against cash if right of offset exists; otherwise, show as liability.

Seasonal adjustments: Monitor for cycles in working capital that affect balances.

Worked Example

Line item | Value | Notes |

|---|---|---|

Physical Currency | $50,000 | Cash on hand |

Bank Deposits | $1,200,000 | Checking and savings accounts |

Money Market Funds | $300,000 | Highly liquid, low-risk |

Short-Term Treasury Bills | $450,000 | Maturing in 60 days |

|

| Sum of above |

Cash and Cash Equivalents = Cash + Cash Equivalents = (50,000 + 1,200,000) + (300,000 + 450,000) = 2,000,000

Cash = Physical Currency + Bank Deposits = 50,000 + 1,200,000 = 1,250,000

Cash Equivalents = Money Market Funds + Short-term Treasury Bills = 300,000 + 450,000 = 750,000

Notes:

90-day rule: All equivalents must convert to cash within 90 days without significant value risk.

Exclude illiquids: No stocks, bonds over 90 days, or restricted funds.

Reporting currency: Convert foreign cash at current exchange rates.

GAAP/IFRS accounting standards compliance: Classify based on intent and ability to liquidate quickly.

Overdraft treatment: Net against cash if right of offset exists; otherwise, show as liability.

Seasonal adjustments: Monitor for cycles in working capital that affect balances.

Worked Example

Line item | Value | Notes |

|---|---|---|

Physical Currency | $50,000 | Cash on hand |

Bank Deposits | $1,200,000 | Checking and savings accounts |

Money Market Funds | $300,000 | Highly liquid, low-risk |

Short-Term Treasury Bills | $450,000 | Maturing in 60 days |

|

| Sum of above |

Cash and Cash Equivalents = Cash + Cash Equivalents = (50,000 + 1,200,000) + (300,000 + 450,000) = 2,000,000

Cash = Physical Currency + Bank Deposits = 50,000 + 1,200,000 = 1,250,000

Cash Equivalents = Money Market Funds + Short-term Treasury Bills = 300,000 + 450,000 = 750,000

Notes:

90-day rule: All equivalents must convert to cash within 90 days without significant value risk.

Exclude illiquids: No stocks, bonds over 90 days, or restricted funds.

Reporting currency: Convert foreign cash at current exchange rates.

GAAP/IFRS accounting standards compliance: Classify based on intent and ability to liquidate quickly.

Overdraft treatment: Net against cash if right of offset exists; otherwise, show as liability.

Seasonal adjustments: Monitor for cycles in working capital that affect balances.

Best Practices

Diversify holdings: Spread across banks and instruments to minimize counterparty risk.

Forecast cash needs: Use rolling 12-month projections to avoid surprises and optimize for yield.

Invest idle cash: Place excess in safe, yield-bearing equivalents like T-bills.

Monitor restrictions: Track and disclose any encumbered cash separately.

Automate reconciliation: Use tools for daily bank feeds to catch discrepancies early.

Best Practices

Diversify holdings: Spread across banks and instruments to minimize counterparty risk.

Forecast cash needs: Use rolling 12-month projections to avoid surprises and optimize for yield.

Invest idle cash: Place excess in safe, yield-bearing equivalents like T-bills.

Monitor restrictions: Track and disclose any encumbered cash separately.

Automate reconciliation: Use tools for daily bank feeds to catch discrepancies early.

Best Practices

Diversify holdings: Spread across banks and instruments to minimize counterparty risk.

Forecast cash needs: Use rolling 12-month projections to avoid surprises and optimize for yield.

Invest idle cash: Place excess in safe, yield-bearing equivalents like T-bills.

Monitor restrictions: Track and disclose any encumbered cash separately.

Automate reconciliation: Use tools for daily bank feeds to catch discrepancies early.

FAQs

What qualifies as a cash equivalent?

Short-term, highly liquid investments with original maturities of 90 days or less and minimal value fluctuation risk.How does this differ from current assets?

Cash and equivalents are a subset of current assets; the latter includes receivables and inventory.Should restricted cash be included?

No, exclude if not available for immediate use; report separately in financial statements. Restricted cash is cash set aside for a specific purpose and not available for general use. It must be reported separately as it is not truly liquid for operational spending.Is this the same as free cash flow?

No, this is a stock (balance sheet) measure; free cash flow is a flow (income/cash flow statement) metric.How do cash and cash equivalents differ from marketable securities?

Marketable securities may include stocks or bonds with longer maturities and higher risk. Only the most liquid instruments meeting strict maturity and risk criteria qualify as cash equivalents.

FAQs

What qualifies as a cash equivalent?

Short-term, highly liquid investments with original maturities of 90 days or less and minimal value fluctuation risk.How does this differ from current assets?

Cash and equivalents are a subset of current assets; the latter includes receivables and inventory.Should restricted cash be included?

No, exclude if not available for immediate use; report separately in financial statements. Restricted cash is cash set aside for a specific purpose and not available for general use. It must be reported separately as it is not truly liquid for operational spending.Is this the same as free cash flow?

No, this is a stock (balance sheet) measure; free cash flow is a flow (income/cash flow statement) metric.How do cash and cash equivalents differ from marketable securities?

Marketable securities may include stocks or bonds with longer maturities and higher risk. Only the most liquid instruments meeting strict maturity and risk criteria qualify as cash equivalents.

FAQs

What qualifies as a cash equivalent?

Short-term, highly liquid investments with original maturities of 90 days or less and minimal value fluctuation risk.How does this differ from current assets?

Cash and equivalents are a subset of current assets; the latter includes receivables and inventory.Should restricted cash be included?

No, exclude if not available for immediate use; report separately in financial statements. Restricted cash is cash set aside for a specific purpose and not available for general use. It must be reported separately as it is not truly liquid for operational spending.Is this the same as free cash flow?

No, this is a stock (balance sheet) measure; free cash flow is a flow (income/cash flow statement) metric.How do cash and cash equivalents differ from marketable securities?

Marketable securities may include stocks or bonds with longer maturities and higher risk. Only the most liquid instruments meeting strict maturity and risk criteria qualify as cash equivalents.

Related Metrics

Commonly mistaken for:

Net Assets (Total assets minus total liabilities)

Total Liabilities (Obligations, not assets)

Equity (Represents ownership, not total resources)

Related Metrics

Commonly mistaken for:

Net Assets (Total assets minus total liabilities)

Total Liabilities (Obligations, not assets)

Equity (Represents ownership, not total resources)

Related Metrics

Commonly mistaken for:

Net Assets (Total assets minus total liabilities)

Total Liabilities (Obligations, not assets)

Equity (Represents ownership, not total resources)

Index