Cash Flow from Investing Activities

Financials

Liquidity

Industry:

Sector Agnostic

Short Definition

Cash Flow from Investing Activities (CFI) represents the net cash inflows and outflows related to the acquisition and disposal of long-term assets and investments. It reflects a company’s investment in or divestment from capital assets, subsidiaries, or other financial instruments.

Short Definition

Cash Flow from Investing Activities (CFI) represents the net cash inflows and outflows related to the acquisition and disposal of long-term assets and investments. It reflects a company’s investment in or divestment from capital assets, subsidiaries, or other financial instruments.

Short Definition

Cash Flow from Investing Activities (CFI) represents the net cash inflows and outflows related to the acquisition and disposal of long-term assets and investments. It reflects a company’s investment in or divestment from capital assets, subsidiaries, or other financial instruments.

Why it matters for Investors

Growth investment signal: High outflows indicate reinvestment in assets or acquisitions, suggesting future growth potential.

Asset management insight: Inflows from sales may show divestment or efficiency in asset utilization.

Capital allocation check: Excessive outflows without returns can signal overinvestment or poor cash management.

Why it matters for Investors

Growth investment signal: High outflows indicate reinvestment in assets or acquisitions, suggesting future growth potential.

Asset management insight: Inflows from sales may show divestment or efficiency in asset utilization.

Capital allocation check: Excessive outflows without returns can signal overinvestment or poor cash management.

Why it matters for Investors

Growth investment signal: High outflows indicate reinvestment in assets or acquisitions, suggesting future growth potential.

Asset management insight: Inflows from sales may show divestment or efficiency in asset utilization.

Capital allocation check: Excessive outflows without returns can signal overinvestment or poor cash management.

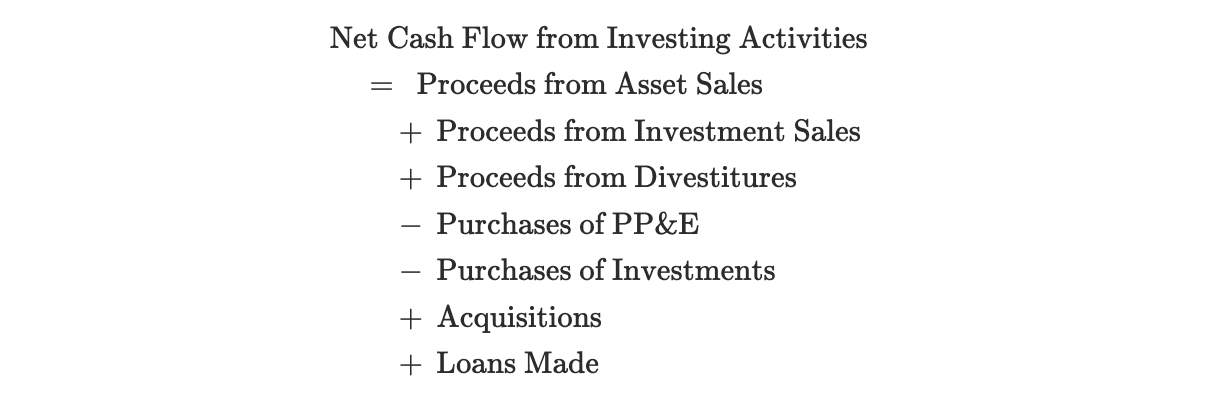

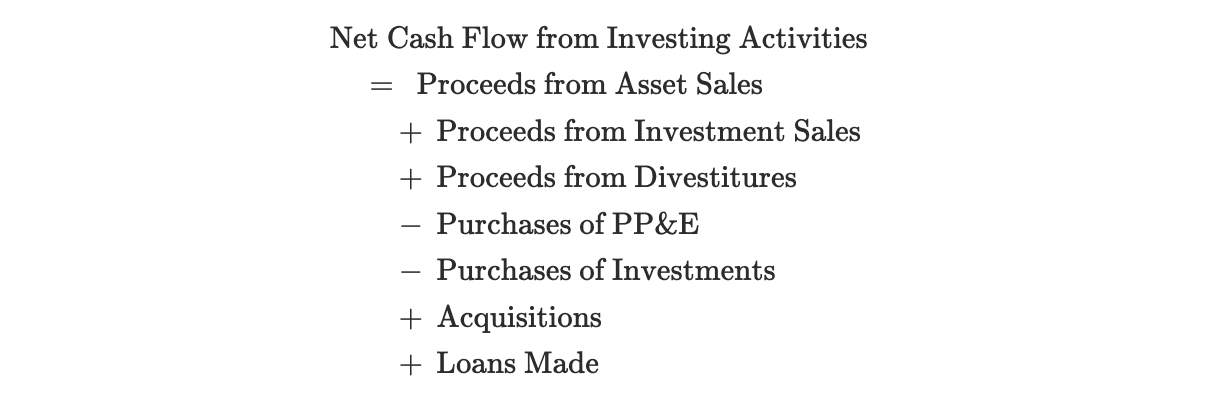

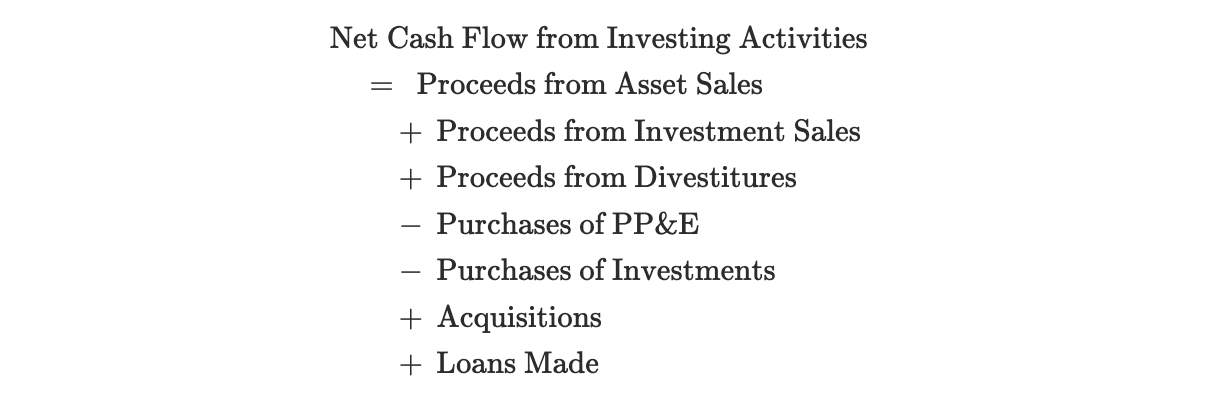

Formula

Practical considerations:

Understand Cash Flow Nature: Cash flow from investing activities (CFI) shows cash spent on or generated from long-term assets and investments, such as property, plant, equipment (PP&E), acquisitions, or sales of business units.

Analyze Spending vs. Generation: Negative CFI commonly indicates investing in growth or fixed assets, which may reduce short-term cash but drive long-term value. Positive CFI often reflects asset sales or divestitures, indicating asset reallocation or portfolio trimming.

Identify One-Time Events: Large one-off investing cash inflows/outflows can skew trends; investors and founders should separate recurring capex from unusual acquisitions or sales.

Examine Asset Quality and ROI: Scrutinize whether investments are in high-return projects or merely maintenance capex; quality investments enhance cash flow sustainability.

Non-Cash Items Impact: Be aware of non-cash investing transactions that don’t affect current cash but will affect future cash or capital structure (e.g., stock-for-asset exchanges).

Correlation with Financing and Operating Cash Flows: Evaluate cash flows from investing in conjunction with funding activities and operational cash flow for comprehensive financial health assessment.

Formula

Practical considerations:

Understand Cash Flow Nature: Cash flow from investing activities (CFI) shows cash spent on or generated from long-term assets and investments, such as property, plant, equipment (PP&E), acquisitions, or sales of business units.

Analyze Spending vs. Generation: Negative CFI commonly indicates investing in growth or fixed assets, which may reduce short-term cash but drive long-term value. Positive CFI often reflects asset sales or divestitures, indicating asset reallocation or portfolio trimming.

Identify One-Time Events: Large one-off investing cash inflows/outflows can skew trends; investors and founders should separate recurring capex from unusual acquisitions or sales.

Examine Asset Quality and ROI: Scrutinize whether investments are in high-return projects or merely maintenance capex; quality investments enhance cash flow sustainability.

Non-Cash Items Impact: Be aware of non-cash investing transactions that don’t affect current cash but will affect future cash or capital structure (e.g., stock-for-asset exchanges).

Correlation with Financing and Operating Cash Flows: Evaluate cash flows from investing in conjunction with funding activities and operational cash flow for comprehensive financial health assessment.

Formula

Practical considerations:

Understand Cash Flow Nature: Cash flow from investing activities (CFI) shows cash spent on or generated from long-term assets and investments, such as property, plant, equipment (PP&E), acquisitions, or sales of business units.

Analyze Spending vs. Generation: Negative CFI commonly indicates investing in growth or fixed assets, which may reduce short-term cash but drive long-term value. Positive CFI often reflects asset sales or divestitures, indicating asset reallocation or portfolio trimming.

Identify One-Time Events: Large one-off investing cash inflows/outflows can skew trends; investors and founders should separate recurring capex from unusual acquisitions or sales.

Examine Asset Quality and ROI: Scrutinize whether investments are in high-return projects or merely maintenance capex; quality investments enhance cash flow sustainability.

Non-Cash Items Impact: Be aware of non-cash investing transactions that don’t affect current cash but will affect future cash or capital structure (e.g., stock-for-asset exchanges).

Correlation with Financing and Operating Cash Flows: Evaluate cash flows from investing in conjunction with funding activities and operational cash flow for comprehensive financial health assessment.

Worked Example

Line Item | Amount | Notes |

|---|---|---|

Purchase of equipment | ($7,000,000) | New machinery (outflow: subtracted) |

Sale of old property | $3,000,000 | Proceeds from land sale (inflow: added) |

Acquisition of subsidiary | ($10,000,000) | Cash paid for business (outflow: subtracted) |

Sale of investments | $4,000,000 | Stocks sold (inflow: added) |

Net Cash from Investing Activities | ($10,000,000) | $3M + $4M - $7M - $10M = -$10M |

Notes:

Negative net CFI reflects net outflows, common during growth phases.

Interest received ($0.2M, if any) would be in Operating Activities under IFRS.

Non-cash items (e.g., $2M asset trade) are excluded but footnoted.

Worked Example

Line Item | Amount | Notes |

|---|---|---|

Purchase of equipment | ($7,000,000) | New machinery (outflow: subtracted) |

Sale of old property | $3,000,000 | Proceeds from land sale (inflow: added) |

Acquisition of subsidiary | ($10,000,000) | Cash paid for business (outflow: subtracted) |

Sale of investments | $4,000,000 | Stocks sold (inflow: added) |

Net Cash from Investing Activities | ($10,000,000) | $3M + $4M - $7M - $10M = -$10M |

Notes:

Negative net CFI reflects net outflows, common during growth phases.

Interest received ($0.2M, if any) would be in Operating Activities under IFRS.

Non-cash items (e.g., $2M asset trade) are excluded but footnoted.

Worked Example

Line Item | Amount | Notes |

|---|---|---|

Purchase of equipment | ($7,000,000) | New machinery (outflow: subtracted) |

Sale of old property | $3,000,000 | Proceeds from land sale (inflow: added) |

Acquisition of subsidiary | ($10,000,000) | Cash paid for business (outflow: subtracted) |

Sale of investments | $4,000,000 | Stocks sold (inflow: added) |

Net Cash from Investing Activities | ($10,000,000) | $3M + $4M - $7M - $10M = -$10M |

Notes:

Negative net CFI reflects net outflows, common during growth phases.

Interest received ($0.2M, if any) would be in Operating Activities under IFRS.

Non-cash items (e.g., $2M asset trade) are excluded but footnoted.

Best Practices

Analyze in Context: Evaluate investing cash flow together with operating and financing cash flows to understand overall business health and capital allocation.

Adjust for One-offs: Adjust for one-time asset sales or acquisitions to avoid misleading conclusions about trend investing activity (normalize cash flow).

Check Capital Expenditures: CapEx is a major driver of investing cash flow; scrutinize to ensure investments align with business strategy and growth plans.

Track Over Time: Monitor over multiple periods to identify strategic shifts, capital intensity, or cash flow sustainability.

Best Practices

Analyze in Context: Evaluate investing cash flow together with operating and financing cash flows to understand overall business health and capital allocation.

Adjust for One-offs: Adjust for one-time asset sales or acquisitions to avoid misleading conclusions about trend investing activity (normalize cash flow).

Check Capital Expenditures: CapEx is a major driver of investing cash flow; scrutinize to ensure investments align with business strategy and growth plans.

Track Over Time: Monitor over multiple periods to identify strategic shifts, capital intensity, or cash flow sustainability.

Best Practices

Analyze in Context: Evaluate investing cash flow together with operating and financing cash flows to understand overall business health and capital allocation.

Adjust for One-offs: Adjust for one-time asset sales or acquisitions to avoid misleading conclusions about trend investing activity (normalize cash flow).

Check Capital Expenditures: CapEx is a major driver of investing cash flow; scrutinize to ensure investments align with business strategy and growth plans.

Track Over Time: Monitor over multiple periods to identify strategic shifts, capital intensity, or cash flow sustainability.

FAQs

What does negative net cash flow from investing activities mean?

It usually means a company is investing in assets or acquisitions to grow, which isn’t bad unless it’s done without sufficient operating cash flow to cover it.Can positive net investing cash flow be bad?

Sometimes yes—positive investing cash flow may indicate asset sales or divestitures due to financial distress or business contraction.How is net cash flow from investing calculated?

Add up all cash inflows from asset sales, investment maturities, and dividends received, then subtract cash outflows for asset purchases, acquisitions, or investments.Why does net investing cash flow fluctuate so much?

Investing cash flow depends on timing of transactions like equipment purchases or sales, acquisitions, or financing of new projects—high variance is common.How should investors use this metric?

As part of a broader cash flow and financial health analysis, particularly evaluating if a company's investing activities are sustainable relative to its operating cash generation.

FAQs

What does negative net cash flow from investing activities mean?

It usually means a company is investing in assets or acquisitions to grow, which isn’t bad unless it’s done without sufficient operating cash flow to cover it.Can positive net investing cash flow be bad?

Sometimes yes—positive investing cash flow may indicate asset sales or divestitures due to financial distress or business contraction.How is net cash flow from investing calculated?

Add up all cash inflows from asset sales, investment maturities, and dividends received, then subtract cash outflows for asset purchases, acquisitions, or investments.Why does net investing cash flow fluctuate so much?

Investing cash flow depends on timing of transactions like equipment purchases or sales, acquisitions, or financing of new projects—high variance is common.How should investors use this metric?

As part of a broader cash flow and financial health analysis, particularly evaluating if a company's investing activities are sustainable relative to its operating cash generation.

FAQs

What does negative net cash flow from investing activities mean?

It usually means a company is investing in assets or acquisitions to grow, which isn’t bad unless it’s done without sufficient operating cash flow to cover it.Can positive net investing cash flow be bad?

Sometimes yes—positive investing cash flow may indicate asset sales or divestitures due to financial distress or business contraction.How is net cash flow from investing calculated?

Add up all cash inflows from asset sales, investment maturities, and dividends received, then subtract cash outflows for asset purchases, acquisitions, or investments.Why does net investing cash flow fluctuate so much?

Investing cash flow depends on timing of transactions like equipment purchases or sales, acquisitions, or financing of new projects—high variance is common.How should investors use this metric?

As part of a broader cash flow and financial health analysis, particularly evaluating if a company's investing activities are sustainable relative to its operating cash generation.

Related Metrics

Commonly mistaken for:

Cash Flow from Operating Activities (Focuses on core business cash flows, not asset transactions)

Cash Flow from Financing Activities (Covers capital raising/repayment, not investing)

Net Income (An accrual-based profit measure, not cash-based)

Related Metrics

Commonly mistaken for:

Cash Flow from Operating Activities (Focuses on core business cash flows, not asset transactions)

Cash Flow from Financing Activities (Covers capital raising/repayment, not investing)

Net Income (An accrual-based profit measure, not cash-based)

Related Metrics

Commonly mistaken for:

Cash Flow from Operating Activities (Focuses on core business cash flows, not asset transactions)

Cash Flow from Financing Activities (Covers capital raising/repayment, not investing)

Net Income (An accrual-based profit measure, not cash-based)

Components:

Index